Do you need to collect and remit sales tax in Arizona?

Along with its 45 brother and sister states, (including the District of Columbia), Arizona charges sales tax. However, the term sales tax is a bit of a misnomer—the correct term for what Arizona collects is Transaction Privilege Tax (TPT), which essentially means taxing a vendor for the privilege of doing business in the state. And if you meet economic or physical nexus in Arizona, you will be required to register to file and remit TPT.

Some exemptions to the rule exist, such as selling through a Marketplace Facilitator or providing services instead of goods.

Read for more detail on Arizona nexus and exemptions below.

Do you have sales tax nexus in Arizona?

Sales tax nexus is the connection between a business and a state. Each state has its own regulations on what constitutes nexus, especially the economic kind. Here are the standards of nexus in Arizona:

Physical sales tax nexus in Arizona

For a business to have physical sales tax nexus in Arizona, it must, in some way, have some tangible presence in the state. The most obvious example of this is a storefront. Other considerations that are made in determining physical nexus are:

- Having assets or property in Arizona.

- A business coming into Arizona to conduct taxable activity.

- Conducting other ongoing business-related activities in Arizona.

Economic sales tax nexus in Arizona

Out-of-state sellers have economic nexus in Arizona if their gross sales or income meet or exceed $100,000 in the current or previous calendar year. This amount does not include sales made through a Marketplace Facilitator licensed with Arizona.

Are marketplace facilitators required to collect and remit sales tax in Arizona?

On October 1st, 2019, Arizona implemented TPT for remote sellers and marketplace facilitators, requiring each to register from a transaction privilege tax license if they meet or exceed economic nexus. If you sell through a marketplace facilitator, you do not have to obtain a TPT license as the marketplace will be collecting and remitting on your behalf. It is important to verify with whatever marketplace you sell through that they are registered with Arizona, so don’t hesitate to ask for documentation.

What platforms are marketplace facilitators?

Not sure what a marketplace facilitator is? In short, marketplace facilitators are companies that provide a platform or service for third-party sellers (you) to sell their products or services to customers. The facilitator collects payment from the customer, processes the transaction, and may also handle shipping and returns.

Filing Arizona Sales Tax

Before collecting and remitting Arizona TPT, businesses must first register for a license from the Arizona Department of Revenue. Businesses that sell into multiple locations within Arizona can either license and report each location separately or have a consolidated license. Each license per location costs 12.00 USD.

There are four ways to apply for a TPT license:

- Online at AZTaxes.gov (note that this option enables businesses to register, file and pay TPT online).

- Arizona Business One Stop (For Arizona-based businesses).

- Complete and mail Joint Tax Application (JT-1), or complete and hand in-person to one of Arizona’s tax offices.

Once registered, taxpayers are strongly encouraged to file their tax returns online via AZTaxes.gov. This is because Arizona has so many cities and counties that filing via paper return can get complicated fast.

Let us file for you!

If filing sales tax returns is too overwhelming or time-consuming, you’re not alone. Running a business is demanding work and filing tax returns is a nuisance. We at SalesTaxSolutions are here to make things easier! As a company, we help businesses like yours deal with the many state-by-state regulations and file your sales tax returns for you. We’ve got 20 plus years of knowledge and experience to help you get back to saving time and making money as soon as possible. Message, email or call us at 888-544-7730 for a free quote today!

When are sales tax returns due in Arizona?

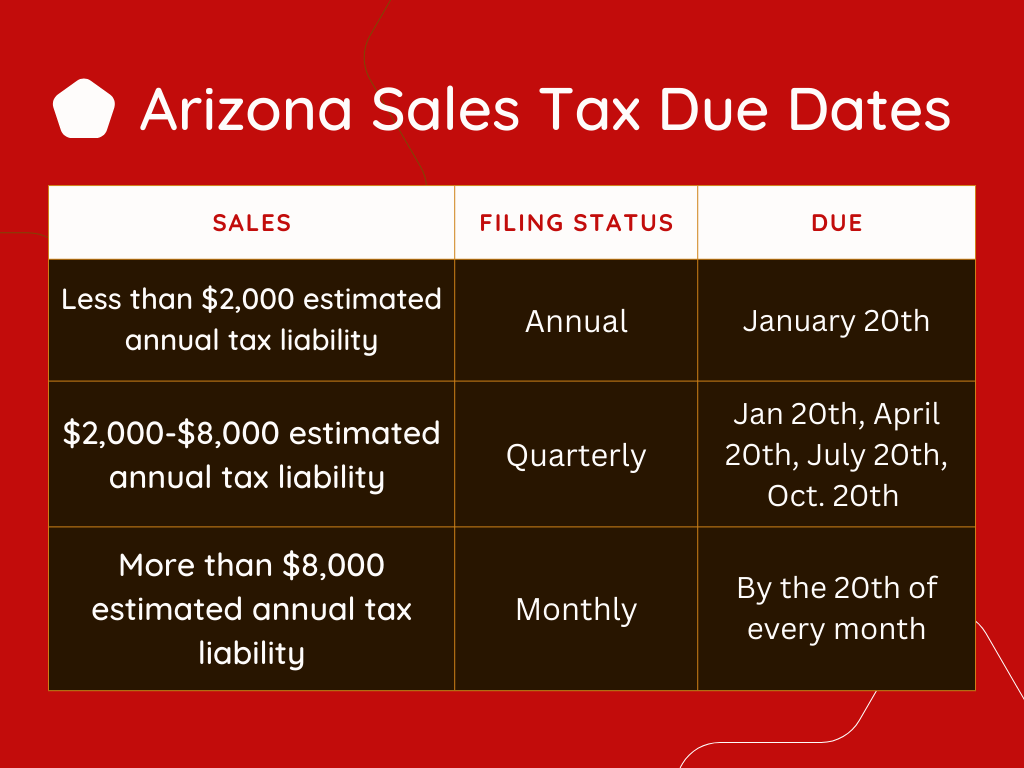

TPT filing frequencies are decided by the business’ total estimated annual combined Arizona, county, and municipal tax liability. See the chart below for a detailed look.

Businesses can request to change their filing frequency by completing and mailing the Business Account Update Form should their filing status not accurately reflect their tax liability.