Do you need to collect and remit sales tax in Illinois?

First we need to answer this question: what is sales tax in Illinois? Illinois sales tax, which is relevant for Illinois sales tax filing, is a combination of occupation tax, (a tax imposed of retailers’ receipts), and use tax, (taxes imposed on the purchaser if the retailer did not charge Illinois sales tax on the item sold). Businesses that sell tangible personal property, provide certain services, or engage in specific contracting activities in Illinois are required to collect and remit occupation tax. Whether a business’s activities are liable for sales tax, a consideration in Illinois business sales tax filing, depends upon whether tangible personal property is involved. For example, installation labor is not taxable if it is contracted separately from the selling price of the object being installed. Some other exemptions from Illinois sales tax filing include:

- Sales to non-profit organizations

- Sales of newspapers and magazines

- Sales of machinery and equipment for manufacturing or production agriculture

- Sales to governmental bodies

Remote sellers or out-of-state retailers with no physical presence in Illinois are also required to collect and remit local retailers’ occupation tax if they have nexus in the state.

Do you have sales tax nexus in Illinois?

Sales tax nexus is a crucial concept for businesses to understand, as it determines whether a company has sufficient connection to a state, requiring them to collect and remit sales tax. In Illinois, businesses have physical nexus if they have a physical presence, employees, or inventory in the state, which is undeniably relevant for Illinois sales tax filing. Businesses with economic nexus are remote sellers who meet a specific sales or transaction threshold to Illinois customers.

Physical sales tax nexus in Illinois

There are two types of businesses that have physical nexus in Illinois: in-state retailers and out-of-state sellers (not to be confused with remote retailers).

- In-state Retailers, relevant when we discuss the context Illinois business sales tax filing are retailers who make sales on tangible personal property in Illinois. They operate out of brick-and-mortar stores or have inventory and headquarters within the state.

- Out-of-state Sellers, significant in terms of Illinois sales tax filing, are different from remote sellers in that they are retailers who live outside of Illinois but still have physical presence there. This means that these businesses have or maintain, either directly or subsidized: offices; distribution houses; warehouses; agents operating within Illinois.

Economic sales tax nexus in Illinois

Remote sellers who have economic nexus in Illinois either:

- Accumulate $100,000 or more in annual gross receipts from Illinois customers

- Make 200 or more annual separate transactions to purchasers in Illinois

Remote retailers, in the context of Illinois sales tax filing, must look at these sales and transaction thresholds on a quarterly basis to determine whether they have Illinois nexus. For example, if one of these retailers looks over their annual sales in June, they will compile data from June-May of the previous year.

Are marketplace facilitators required to collect and remit sales tax in Illinois?

Illinois tax law requires marketplace facilitators to collect and remit sales tax on behalf of their marketplace sellers for Illinois business sales tax filing. This only applies if the marketplace facilitator meets the tax remittance thresholds that apply to any remote retailer, i.e., over $100,000 of annual Illinois sales or 200 annual Illinois transactions.

What platforms are marketplace facilitators?

Not sure what a marketplace facilitator is? In short, marketplace facilitators are companies that provide a platform or service for third-party sellers (you) to sell their products or services to customers. The facilitator collects payment from the customer, processes the transaction, and may also handle shipping and returns.

Illinois Sales Tax Filing

Ready to register your business with Illinois and file your taxes? Use the table below for step-by-step instructions and resources to make the process easy-peasy.

| Step | Action | Resources |

| 1 | Register for an account with MyTax Illinois, either by paper form or online | MyTax Illinois; Form REG-1 |

| 2 | Complete corresponding schedules for your business if necessary, (such as Liquor Information, Illinois Business Site Location Information, Owner and Officer Information, etc.) | Business Registration Forms |

| 3 | Wait for your Certificate of Registration and taxpayer ID to be processed. Note: Illinois no longer prints and mails most tax certificates. They are issued electronically through MyTax Illinois. | MyTax Illinois |

| 4 | File your occupational tax return on a monthly, quarterly, or annual basis, depending upon what type of filing frequency you are assigned. You can file electronically or by mail. | MyTax Illinois; Form ST-1 |

| 5 | Pay the amount owed based on the tax rates for state and local sales, based upon the customer’s zip code. | Illinois Tax Rate Database |

| 6 | Keep accurate records of all tax returns and payments made. | Use your own internal documentation and record-keeping needs! |

Let us file for you!

SalesTaxSolutions offers a variety of sales tax services, such as Illinois sales tax filing, to help businesses follow tax regulations. We provide simple and efficient sales tax procedures, handling the entire process so businesses can focus on their goals. We also offer email and phone support, as well as excellent customer service, including one-on-one meetings by request. No need to worry about sales tax return filing, account registrations, notice handling, or license renewals; we’ve got your back!

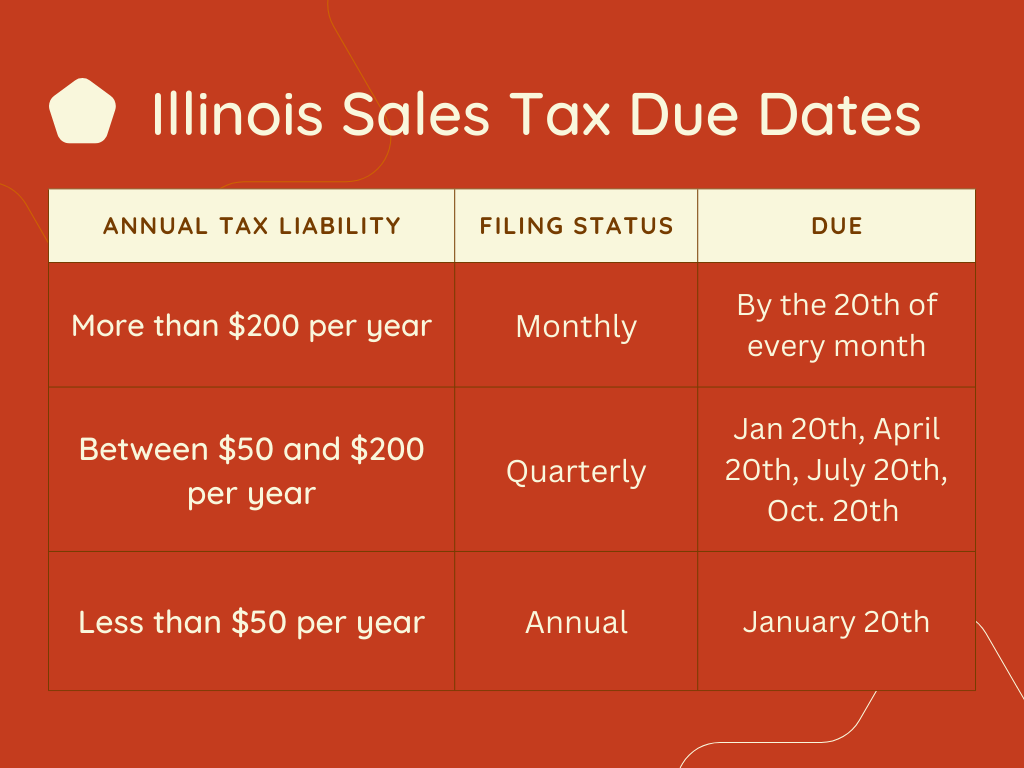

When are sales tax returns due in Illinois?

Illinois taxpayers are assigned a monthly, quarterly or annual filing frequency depending on their annual tax liability. See the graphic below for a breakdown of these filing frequencies and their due dates.