Do you need to collect and remit sales tax in Kansas?

According to the Kansas Department of Revenue, businesses with a taxable presence or “nexus” in the state must collect and remit state and local taxes. This includes: retail sales, rentals or leases of tangible personal property; labor services to install, apply, repair, service, alter, or maintain tangible personal property; admissions to entertainment, amusement, or recreation places in Kansas. Having taxable presence can be as simple as having a storefront in Kansas, but for many businesses, knowing whether they have sales tax in Kansas obligations can get a little more complicated. That is where nexus comes in to play. We’ll explain more about nexus in the next section.

Do you have sales tax nexus in Kansas?

Nexus—in the context of sales tax—refers to the connection or presence a business has within a state, which requires them to collect and remit sales tax. In Kansas, a business is considered to have nexus for State of Kansas sales tax filing if it maintains a physical presence—such as an office or warehouse—or has significant economic presence, i.e. exceeding an amount of sales to customers in-state.

Physical sales tax nexus in Kansas

Physical sales tax nexus, which is all about physical presence, is key for understanding sales tax in Kansas. Here are examples of businesses that might have physical nexus in Kansas:

- Any retailer with an office, distribution house, sales house, warehouse, etc.

- Having a subsidiary, agents or representatives in-state.

- Having an employee(s), independent contractor, agent, salesperson, or other people operating in Kansas to sell goods or services.

- Maintaining a stock of tangible personal property in Kansas for sale.

Economic sales tax nexus in Kansas

Having economic nexus is determined by exceeding $100,000 in Kansas retail sales in the current or previous calendar year.

Determining nexus for your business can be a complex and daunting task. With many factors to consider, many businesses struggle to navigate the intricacies of nexus determination, and even end up paying thousands of dollars to accounting firms to get answers. That’s why we offer nexus determination, including State of Kansas sales tax filing, as an a-la-carte or package deal for businesses at affordable prices. With over 20 years of experience in federal and state tax and accounting laws, we’re a trusted partner for many businesses in need of nexus review services. Contact us now for a consultation!

Are marketplace facilitators required to collect and remit sales tax in Kansas?

Yes, marketplace facilitators are required to collect and remit sales tax in Kansas on behalf of the sellers using their platforms. Marketplace facilitators that are located in Kansas need to register for, collect, and remit Kansas retailers’ sales tax, whereas marketplace facilitators located outside of Kansas will collect and remit Kansas retailers’ compensating use tax. However, the location of the seller who is using the marketplace doesn’t affect tax type. Just like any other Kansas taxpayer, marketplace facilitators need to register with the department to collect and remit sales tax in Kansas for its sellers, so it is important to check with whatever facilitator you use that they are registered to avoid any penalties or potential legal repercussions.

What platforms are marketplace facilitators?

Not sure what defines a marketplace facilitator? In short, marketplace facilitators are companies that provide a platform or service for third-party sellers (you) to sell their products or services to customers, often involving State of Kansas sales tax filing.. The facilitator collects payment from the customer, processes the transaction, and may also manage shipping and returns.

Filing Sales Tax in Kansas

Before you can file Kansas sales and use taxes, you must first be registered with the department of revenue and receive a certificate. There are three ways to do this:

| Option | Information | Resource |

| Online Registration | Businesses can register online with Kansas for most taxes. Additionally, corporations can register with the Secretary of State via the online portal. | Kansas Department of Revenue Customer Service Center |

| Paper Form | The Kansas Business Tax Application can be completed and either mailed or faxed to the Kansas Department of Revenue. | Business Tax Application (CR-16) |

| Through Streamlined Sales Tax | Kansas is one of many states that are members of Streamlined Sales Tax, which is an online resource for businesses that need to register for sales tax in multiple states. Using one application, businesses can register for any or all the member states to streamline their registration process. | Streamlined Sales Tax |

Once you have registered with Kansas and received a sales tax certificate, you can collect and remit sales tax in Kansas. Kansas is one of a few states that requires online filing regardless of filing frequency or tax liability, so however you choose to register your business, you will need to create an account on the Kansas Department of Revenue Customer Service Center.

Let us file for you!

If filing State of Kansas sales tax returns is too overwhelming or time-consuming, you’re not alone. Running a business is demanding work and filing tax returns is a nuisance. We at SalesTaxSolutions are here to make things easier! As a company, we help businesses like yours deal with the many state-by-state regulations and file your sales tax returns for you. We’ve got 20 plus years of knowledge and experience to help you get back to saving time and making money as soon as possible. Message, email or call us at 888-544-7730 for a free quote today!

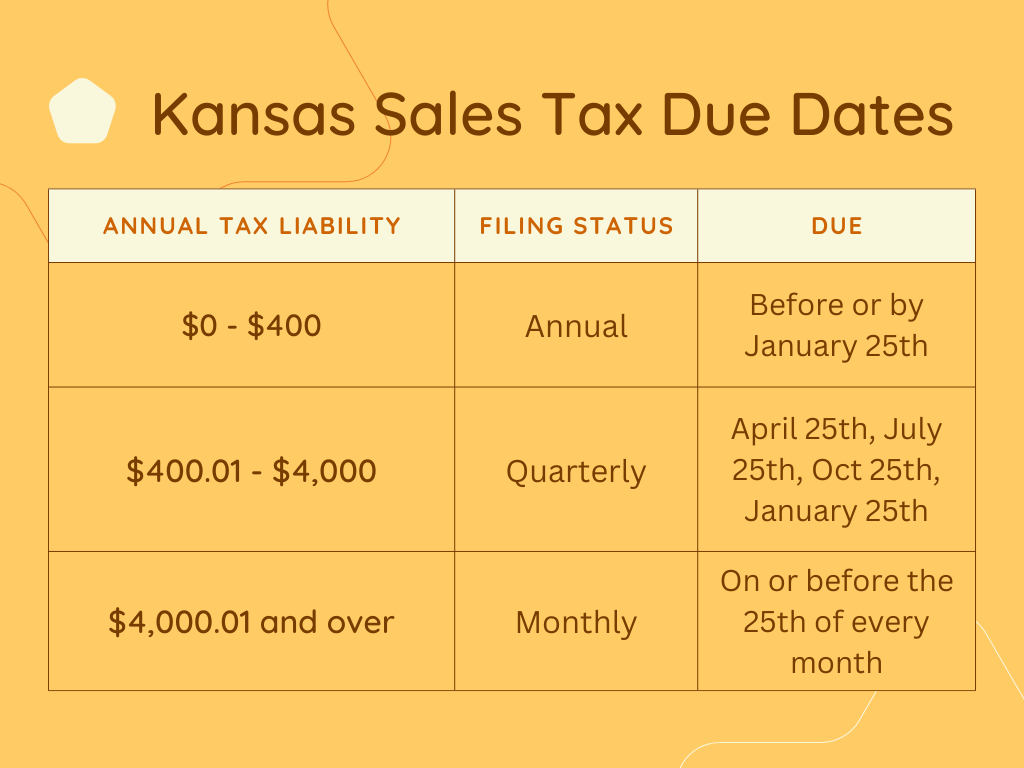

When are sales tax returns due in Kansas?

Like many states, Kansas assigns a filing frequency to taxpayers at the time of registration for sales tax in Kansas. This frequency is subject to change during an annual review. We’ve created the graphic below to break down when sales tax returns are due in Kansas, and how they correspond with annual tax liability.