Do you need to collect and remit sales tax in Kentucky?

In Kentucky, businesses engaged in selling tangible personal property or various services are required to collect and remit sales tax. This obligation applies to businesses with a physical presence or economic nexus in the state, which can be established through owning property, having employees, or reaching a certain sales threshold. However, not all transactions are taxable—Kentucky offers nontaxable exemptions for specific items or services, such as:

- Services provided to tax-exempt organizations such as school districts or certain governmental entities.

- Sales for resale, which is tangible personal property and digital property that is purchased by another seller who issues a Resale Certificate.

- Interstate commerce sales, which is property purchased to be delivered to a location outside of Kentucky.

Do you have sales tax nexus in Kentucky?

We have already established that Kentucky imposes state sales tax on sales of tangible personal property and some services, but when does a business have nexus and how is it defined? There are two types of nexuses as it applies to sales tax in Kentucky: physical and economic. In Kentucky, businesses that have physical nexus or physical presence will perform their activities from a location such as an office, warehouse, or store necessitating in Kentucky sales and use tax filing. Economic nexus is reserved for out-of-state businesses that sell into the state. This type of nexus is established by a certain number of sales or transactions. Below you will find more detail about these two nexuses and when they might apply to a business.

Physical sales tax nexus in Kentucky

A few examples of physical nexus in Kentucky are:

- Having a storefront

- Storing inventory for sale in a warehouse

- Owning or operating from an office space

- Having employees working in the state

- Sending employees or contractors to Kentucky to provide services

Economic sales tax nexus in Kentucky

Economic nexus for sales tax in Kentucky is triggered when an out-of-state or remote retailer earns $100,000 or more gross income from Kentucky customers or has 200 or more transactions into Kentucky. This applies to the previous as well as the current year. Remote sellers must register and begin sales tax remittance by the first day of the calendar month after either of these thresholds is reached.

Determining nexus for your business can be a complex and daunting task. With many factors to consider, many businesses struggle to navigate the intricacies of nexus determination, and even end up paying thousands of dollars to accounting firms to get answers. That’s why we offer nexus determination for sales tax in Kentucky, as an a-la-carte or package deal for businesses at affordable prices. With over 20 years of experience in federal and state tax and accounting laws, including Kentucky sales and use tax filing we’re a trusted partner for many businesses in need of nexus review services. Contact us now for a consultation!

Are marketplace facilitators required to collect and remit sales tax in Kentucky?

Yes, marketplace facilitators are required to collect and remit sales tax on behalf of their third-party sellers. This law has been set by Kentucky to ensure that these sales are subject to the same sales tax collection and remittance requirements as other retailer sales. It is important to note that marketplace facilitators are subject to the same economic nexus thresholds as any other remote retailer, so if a facilitator does not have nexus, then it is not required to collect and remit sales tax. Businesses that use marketplace facilitators are encouraged to contact the facilitator and request proof of registration with Kentucky before assuming they have no responsibility for sales tax in Kentucky.

What platforms are marketplace facilitators?

Not sure what defines a marketplace facilitator? In short, marketplace facilitators are companies that provide a platform or service for third-party sellers (you) to sell their products or services to customers. The facilitator collects payment from the customer, processes the transaction, and may also manage shipping and returns.

Kentucky Sales and Use Tax Filing

Getting all your ducks in a row to prepare to file your sales tax returns can be intimidating, so we’ve prepared this step-by-step table to help keep your requirements for the sales tax in Kentucky requirements in line with current regulations.

| Step | Task | Resources |

| 1 | Determine if your business has sales tax nexus in Kentucky | Refer to the aforementioned information in this guide. If you need more detailed information to determine nexus, you can refer to Kentucky’s Sales & Use Information or the Kentucky Contact page. Additionally, you can Contact Us for a nexus review. |

| 2 | Register your business with the Kentucky Department of Revenue | There are three ways you can register your business with Kentucky: Online – The Kentucky Business One Stop allows you to file for registration online. This registration will also automatically enroll your business in common business taxes, including use and sales tax in Kentucky. Paper Form – Kentucky still allows applications for registration via Form 10A100. Processing paper applications do take longer than online registrations by approximately 5-10 business days. Businesses that use the paper form will also need to complete a second application to register for return Kentucky sales and use tax filing. Streamlined Sales Tax – Kentucky is one of 24 states that are members of Streamlined Sales tax, which is an online resource for businesses that need to register for sales tax in multiple states. Using one application, you can register with Kentucky and any of the other 24 member states. |

| 3 | Collect sales tax on taxable sales made in Kentucky | As there are no local options for sales tax in Kentucky, you will collect sales tax at a flat 6% rate. |

| 4 | File sales tax returns on a regular basis, even if no tax is due | As of October 2021, Kentucky requires sales and excise tax returns to be filed and paid online using the Kentucky Business One Stop Portal. |

| 5 | Ensure you keep accurate sales tax filing and collection records | Audits can happen to anyone. To protect yourself and your business, ensure that you keep detailed tax records for at least four years. |

Kentucky taxpayers that file and pay their sales tax in Kentucky on time, (before or by their filing frequency due date), can collect a vendor’s compensation of 1.75% of the first $1,000 tax due, and 1.5% of any amount over $1,000. This compensation caps at $50.

Let us file for you!

If Kentucky sales and use tax filing is too overwhelming or time-consuming, you’re not alone. Running a business is demanding work and filing tax returns is a nuisance. We at SalesTaxSolutions are here to make things easier! As a company, we help businesses like yours deal with the many state-by-state regulations and file your sales tax returns for you. We’ve got 20 plus years of knowledge and experience in sales tax in Kentucky to help you get back to saving time and making money as soon as possible. Message, email or call us at 888-544-7730 for a free quote today!

When are sales tax returns due in Kentucky?

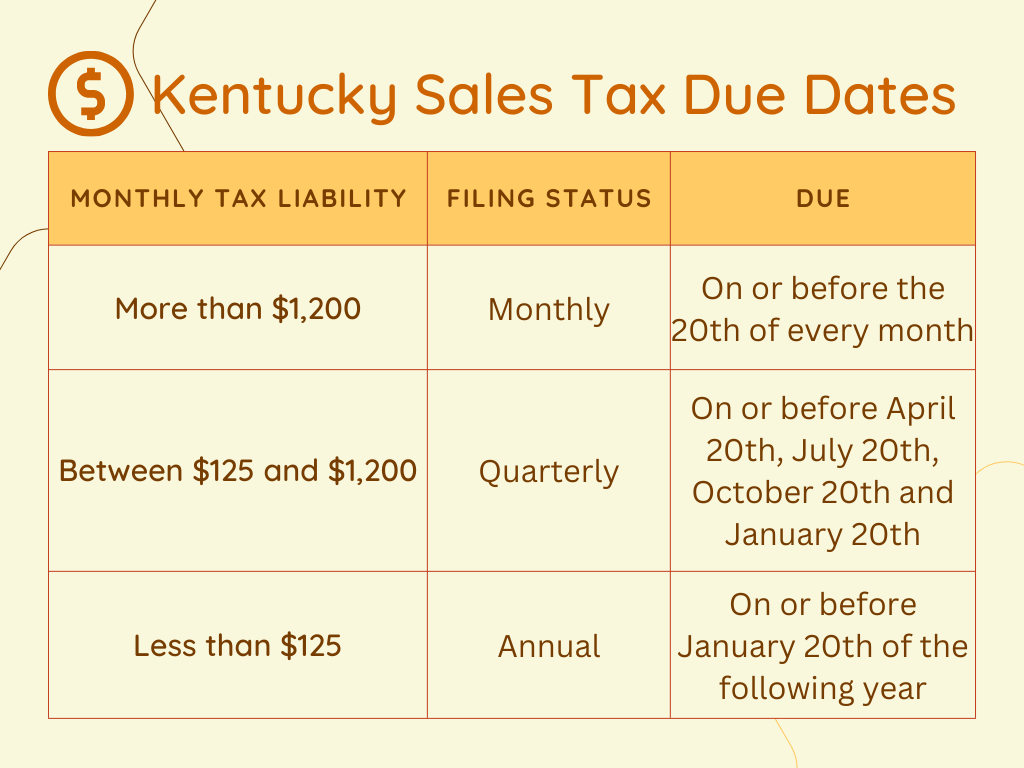

Kentucky will assign a filing frequency to your business based on the information you give on your application and your monthly sales tax liability. See the graphic below for the different due dates and their associated frequencies.

Note that all accounts are reviewed on an annual basis and any adjustments the Kentucky Department of Revenue may make to your filing frequency are normally in June, (since Kentucky’s fiscal year is from July 1st – June 30th).