Do you need to collect and remit sales tax in Maine?

Businesses operating in Maine are required to collect and remit sales tax if they sell most tangible personal property, certain services, and specified digital products. Additionally, remote retailers and marketplace facilitators exceeding a set threshold of sales or transactions into the state are also responsible for sales tax. However, there are certain exemptions and exclusions. For example, sales of groceries, prescription drugs, crutches and wheelchairs, menstrual products, and rentals of certain living quarters such as rentals to students attending school or non-profit organizations or institutions. You can find a full list of taxable/exempt items and services in Maine here.

Do you have sales tax nexus in Maine?

Sales tax nexus is a crucial concept for businesses, as it determines whether a business must collect and remit sales tax in a state. There are two primary types of nexus to consider: physical and economic.

Physical sales tax nexus in Maine

Physical nexus in Maine is established when a business maintains a tangible presence within the state. Examples of physical nexus include:

- Operating or maintaining a store, office, manufacturing facility, distribution facility, or warehouse in Maine.

- Having an employee(s) traveling within the state to solicit sales.

- Having other substantial physical presence such as owning or leasing any real property in Maine for business purposes.

- Having an employee(s) providing repair, installation, or maintenance services within Maine.

Economic sales tax nexus in Maine

Economic nexus focuses on economic activity into a state. In Maine, a business is considered to have economic nexus if it has:

- More than $100,000 of Maine gross sales, or;

- 200 or more separate transactions into Maine.

Either of these thresholds apply to the current or previous calendar year.

Determining nexus for your business can be a complex and daunting task. With many factors to consider, many businesses struggle to navigate the intricacies of nexus determination, and even end up paying thousands of dollars to accounting firms to get answers. That’s why we offer nexus determination as an a-la-carte or package deal for businesses at affordable prices. With over 20 years of experience in federal and state tax and accounting laws, we’re a trusted partner for many businesses in need of nexus review services. Contact us now for a consultation!

Are marketplace facilitators required to collect and remit sales tax in Maine?

Marketplace facilitators must collect and remit sales tax on behalf of their third-party sellers if they meet the economic nexus threshold of $100,000 in sales or 200 transactions into Maine. This means that if a marketplace facilitator exceeds these thresholds, they are required to register with the state, whereas the remote sellers using the marketplace are not responsible for those taxes.

To ensure compliance, remote sellers should communicate with their marketplace to determine whether sales tax is being collected and remitted on their behalf. This can be done by reviewing the facilitator’s terms and conditions, contacting customer support, or requesting a copy of their Maine registration for verification. Even if remote sellers aren’t responsible for taxes collected on marketplace sales, it is best practice to maintain accurate records of sales and transactions to safeguard their business.

What platforms are marketplace facilitators?

Not sure what defines a marketplace facilitator? In short, marketplace facilitators are companies that provide a platform or service for third-party sellers (you) to sell their products or services to customers. The facilitator collects payment from the customer, processes the transaction, and may also manage shipping and returns.

Filing Maine Sales Tax

Sometimes, it’s hard to take that first step. If you’re struggling to keep all of Maine’s tax rules and regulations sorted, take a look at our step-by-step table below.

| Step | Task | Instructions | Resources |

| 1 | Determine if you need to register | Determine if you have met the economic nexus threshold or have physical presence in Maine. If you do, you must register for a sales tax account with Maine Revenue Services (MRS). | Use the information in this article to help you determine if you have nexus. Additionally, you can find more information in the Maine Sales and Use Tax Reference Guide, or Contact Us for a consultation. |

| 2 | Gather necessary information | Before registering, gather applicable business information such as: Business Name Business Address Federal Employer Identification Number (FEIN) Social Security Number (SSN) of business owner or responsible party North American Industry Classification System (NAICS) code for your business | NAICS Codes |

| 3 | Register for a sales tax account | Register for a sales tax account with Maine Revenue Services (MRS) using either the online portal or by filling out and sending a paper registration. | Online Registration; Paper Application |

| 4 | Collect sales tax | Collect sales tax on all taxable sales made in Maine according to the current sales tax rate. | |

| 5 | File sales tax returns | File sales tax returns with the MRS on a monthly, quarterly, semi-annual or annual basis, depending on the filing frequency Maine assigns to your business. Returns can be filed online or by mail. To file online returns, you will have to have an account on the Maine Tax Portal. | Form ST-7 Sales Tax Paper Return; Online Filing Tax Portal |

| 6 | Pay sales tax | Pay any sales tax owed to the MRS by the due date. All sales tax returns are due on the 15th day of the month following a reporting period. Payments can be made online or via mailed check. | When filing your return electronically, you will be prompted to click “Make Payment” once the return has been filed. |

| 7 | Maintain accurate records | Maintain records of all sales made in Maine, as well as sales tax collected and remitted, for at least 6 years. | Recordkeeping Requirements for Sales Tax Vendors |

Let us file for you!

If filing sales tax returns is too overwhelming or time-consuming, you’re not alone. Running a business is demanding work and filing tax returns can be a pain, especially when you need to keep up with all the different rules and regulations. We at SalesTaxSolutions.US are here to make things easier! As a company, we help businesses like yours deal with the many state-by-state regulations and file your sales tax returns for you. We’ve got 20 plus years of knowledge and experience to help you get back to saving time and making money as soon as possible. Message, email or call us at 888-544-7730 for a free quote today!

When are sales tax returns due in Maine?

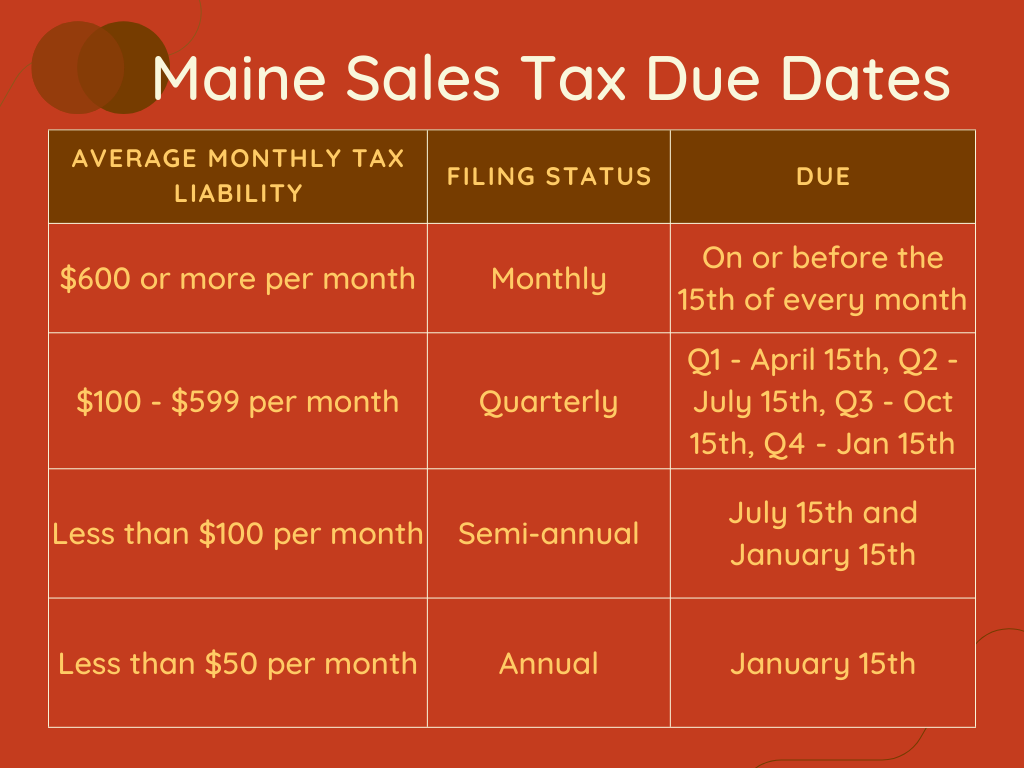

Maine sales tax filing frequencies are assigned to taxpayers when Retailer’s Certificates are processed and are typically based on average monthly tax liability. There are four filing frequencies in Maine: monthly, quarterly, semi-annually, and annually. See our graphic below for a detailed look at which tax liabilities correspond with which filing status.

Note: If the 15th falls on a weekend or State Holiday, the tax due date will move to the next business day.