Do you need to collect and remit sales tax in Massachusetts?

If you are a vendor that sells tangible personal property in Massachusetts, you are required to collect and remit sales tax. This includes retail stores, online vendors, and out-of-state vendors that meet certain criteria. There are some exemptions and special cases where sales tax may not be required, such as sales of certain types of food or sales to tax-exempt organizations. You can find a complete list of exemptions and special cases here.

Do you have sales tax nexus in Massachusetts?

Sales tax nexus—the connection between a seller and a state that requires the seller to collect and remit sales tax—is a crucial concept for businesses, especially those that operate in multiple states. There are two types of nexus: physical and economic. Physical nexus occurs when a business has a tangible presence in Massachusetts, such as an office, warehouse, or employees. Economic nexus is established when a business reaches a certain sales threshold, even without physical presence. We break down more details about nexus below.

Physical sales tax nexus in Massachusetts

Some examples of physical sales tax nexus in Massachusetts include:

- Having a business location in Massachusetts

- Having representatives soliciting orders or telecommunications services within Massachusetts

Economic sales tax nexus in Massachusetts

Economic nexus in Massachusetts is triggered when a business with no physical presence in the state makes over $100,000 in sales to Massachusetts customers in a calendar year.

Determining nexus for your business can be a complex and daunting task. With many factors to consider, many businesses struggle to navigate the intricacies of nexus determination, and even end up paying thousands of dollars to accounting firms to get answers. That’s why we offer nexus determination as an a-la-carte or package deal for businesses at affordable prices. With over 20 years of experience in federal and state tax and accounting laws, we’re a trusted partner for many businesses in need of nexus review services. Contact us now for a consultation!

Are marketplace facilitators required to collect and remit sales tax in Massachusetts?

In Massachusetts, marketplace facilitators are responsible for collecting and remitting sales tax on behalf of their sellers. Key points to keep in mind include:

- Massachusetts law requires marketplace facilitators to collect and remit sales tax when their sales volume exceeds $100,000 annually.

- This requirement applies even if the individual sellers on the platform do not meet the sales threshold themselves.

- Businesses using marketplace facilitators should ensure they are aware of the facilitator’s compliance with Massachusetts sales tax laws.

What platforms are marketplace facilitators?

Not sure what defines a marketplace facilitator? In short, marketplace facilitators are companies that provide a platform or service for third-party sellers (you) to sell their products or services to customers. The facilitator collects payment from the customer, processes the transaction, and may also manage shipping and returns.

Filing Massachusetts Sales Tax

If you need to register and file sales tax returns with the state of Massachusetts and don’t know where to start, take a look at this table for a step-by-step guide for that you can reference no matter where you are in your sales tax filing journey!

| Step | Information & Resources | Helpful Tips |

| Determine if your business needs to register for sales tax in Massachusetts. | Massachusetts Sales and Use Tax Guide | We’ve provided information in this article on how to determine if your business needs to collect and remit sales tax in Massachusetts. If you need more information, check out Massachusetts’ guide or contact us for a nexus review. |

| Register for a Massachusetts sales tax permit | MassTaxConnect; How To Register | Massachusetts only offers online registration. After your registration is processed, you will receive a Sales and Use Tax Registration Certificate (ST-1). Keep your permit number handy; you’ll need it! |

| Collect the correct amount of sales tax from customers | Massachusetts Sales and Use Tax For Businesses | Always check the current sales tax rate to ensure accuracy. Currently, Massachusetts does not levy local taxes, but you never know if that could change. |

| File and pay Massachusetts sales tax returns on time | Filing and Paying Sales and Use Tax; Online Filing | Sales and use taxpayers must file and remit their sales tax payments electronically. Additionally, sales tax returns must be filed for all periods assigned to a taxpayer, even if no tax is due. |

| Keep accurate records of sales tax collected and paid | Sales tax records must be kept for at least 3 years from the date the return was filed. Returns can be audited for up to 6 years if taxpayers understate tax by more than 25%. |

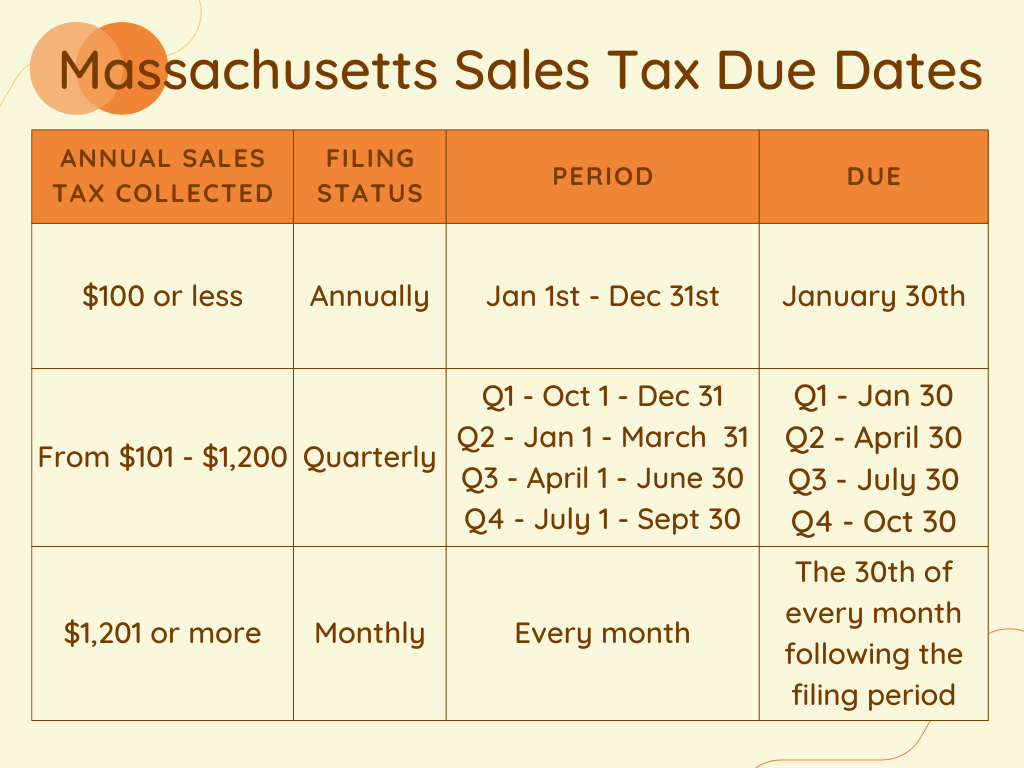

When are sales tax returns due in Massachusetts?

Massachusetts has three main filing frequencies: monthly, quarterly and annually. Additionally, there are advanced payment requirements for businesses with over $150,000 in cumulative tax liability in the prior year. Check out our graphic below for details on the filing frequencies, their due dates, and the associated tax liabilities.