Do you need to collect and remit sales tax in Minnesota?

In Minnesota, businesses and individuals who make retail sales or provide taxable services must collect and remit sales tax. Taxable sales include retail sales, utilities, television services, and vending machine sales. Some services are also taxable, such as building cleaning and maintenance, massages, pet grooming and more. You can find a full list of taxable sales and services here.

But where there are taxable items, there are exemptions as well. Minnesota considers agricultural and farming items, baby products, caskets and urns, and construction labor nontaxable. Click here for a full list of nontaxable sales in Minnesota.

Do you have sales tax nexus in Minnesota?

Sales tax nexus is a connection or presence a business has within a state that requires them to collect and remit sales tax. In Minnesota, nexus can be established through either physical or economic presence. Physical nexus is created when a business has a physical location, employees, or inventory within the state. On the other hand, economic nexus is established when a business meets certain sales thresholds in the state, and only applies if that business does not have any physical presence. We get into the details of both below.

Physical sales tax nexus in Minnesota

Businesses that have physical nexus in Minnesota will do the following:

- Maintain a physical location in Minnesota

- Have employees, representative, agents, or independent contractors that do work in Minnesota

- Deliver items into Minnesota with company vehicles

- Own property in Minnesota

- Keep inventory in a fulfillment center in Minnesota

Economic sales tax nexus in Minnesota

Remote sellers that meet certain sales and transaction thresholds will have economic nexus in Minnesota. These thresholds are:

- 200 or more transactions made to Minnesota

- More than $100,000 in retail sales to customers in Minnesota

Both thresholds apply to the previous 12-month period. If a seller doesn’t meet either of these thresholds, they are exempt from collecting sales and use tax under the Small Seller Exception.

Determining nexus for your business can be a complex and daunting task. With many factors to consider, businesses struggle to navigate the intricacies of nexus determination, and even end up paying thousands of dollars to accounting firms to get answers. That’s why we offer nexus determination as an a-la-carte or package deal for businesses at affordable prices. With over 20 years of experience in federal and state tax and accounting laws, we’re a trusted partner for many businesses in need of nexus review services. Contact us now for a consultation!

Are marketplace facilitators required to collect and remit sales tax in Minnesota?

A marketplace facilitator is an entity that facilitates sales between a buyer and a seller, often through online platforms. In Minnesota—as of October 1, 2019—out-of-state marketplace providers must collect and remit state and local sales tax if they meet the same economic thresholds set for every remote retailer, (i.e., 200 or more transactions or over $100,000 in retail sales shipped to Minnesota).

For businesses using marketplace facilitators, it is essential to ensure that the facilitator is registered for a Minnesota Tax ID Number and is collecting and remitting sales tax on their behalf. This responsibility falls on the facilitator, but a business should verify their compliance to avoid potential issues.

What platforms are marketplace facilitators?

Filing Minnesota Sales Tax

We’ve covered what business activities and sales are taxable in Minnesota, the different types of nexuses, and marketplace facilitator laws. Now it’s time to figure out just how to file and pay Minnesota sales tax. We’ll provide an overview of the process, including step-by-step instructions for registering for a Minnesota Tax ID, Sales Tax Account, and how to file and pay.

- Register for a Minnesota Tax ID

- Online registration: Scroll down to Business Registration and click on Get a Minnesota Tax ID Number.

- Ensure you have the correct business information, including Federal Employer ID Number (FEIN), business name and address, and NAICS code.

- Visit the MN e-services website. Additionally, you can call 651-282-5225 or 1-800-657-3605 (toll-free) to register over the phone.

- Follow the prompts and complete the registration process.

- You will receive a confirmation with you Minnesota Tax ID Number.

- Register for a Minnesota Sales Tax Account

- When registering for a Minnesota ID number, you can also register for a Sales and Use Tax account.

- Note: When registering for a sales and use tax account, you will need to provide your expected filing frequency. Minnesota has three filing frequencies: monthly, quarterly and annual. We will go into more detail about how to estimate your filing frequency in the next section.

- File and Pay Minnesota Sales Tax

- Minnesota sales tax returns can only be filed online using e-services.

- Log in to your e-services account.

- Navigate to the Sales and Use Tax section.

- Enter sales and use tax information, including state and local taxes.

- Pay the sales tax due using the available payment options. Payments made directly from a bank account typically have no service fees, while Credit or Debit Card payments do.

Overwhelmed and struggling to navigate the complex world of sales tax compliance? You’re not alone. Many businesses find themselves in that very situation, which is where SalesTaxSolutions.US comes in. As a trusted provider of comprehensive sales tax consulting services for businesses of all sizes and industries, our team of experts is dedicated to helping you streamline your sales tax processes and stay compliant with changing regulations. We handle the entire process for you, from nexus reviews to registration to filing. Reach out to us today!

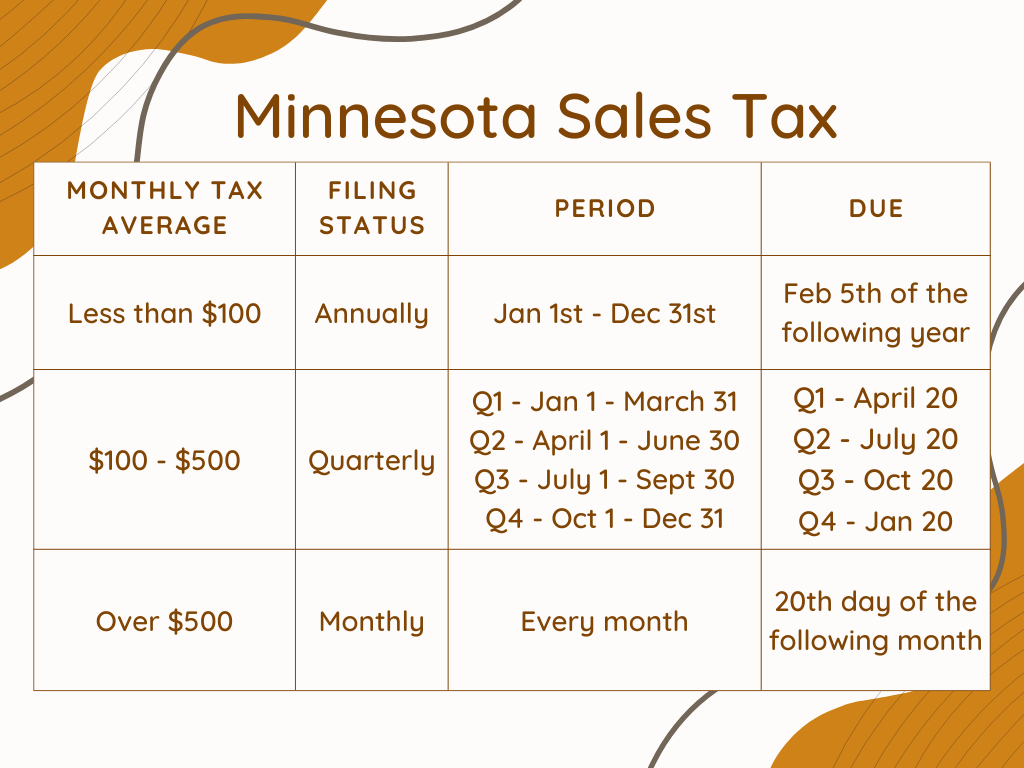

When are sales tax returns due in Minnesota?

Every state has different filing frequencies and sales tax return due dates. Minnesota, like many states, assigns filing frequencies based on tax liability. The more average tax per month, the more often a business will need to file. When registering for a sales tax account, you will be required to estimate which filing frequency applies to your business.

Each Minnesota filing frequency—monthly, quarterly, and annual—is associated with a different average tax liability. See the graphic below for a breakdown.