Do you need to collect and remit sales tax in New York?

In New York, sales of tangible personal property are subject to sales tax, unless they fall under specific exemptions. If you run a business selling taxable products to consumers in New York, you’re responsible for collecting and remitting sales tax—even if you only operate seasonally.

To comply with these requirements, vendors with sales tax obligations must register with the New York Tax Department and secure a Certificate of Authority at least 20 days before selling taxable products or services.

However, there are exemptions in certain situations. For instance, services are usually exempt from New York sales tax. Remote sellers with no physical location or presence in New York are also exempt unless they exceed the economic nexus thresholds set by the state. More examples of exemptions include:

- Purchases for resale

- Most sales involving federal and state governments

- Sales of most food items for home consumption

- Sales of medical care

To explore a more comprehensive list of non-taxable transactions, click here.

Do you have sales tax nexus in New York?

Sales tax nexus refers to the connection a business has with a state, which requires the seller to collect and remit sales tax in that state. In New York, sales tax nexus can be established through physical presence or economic activity.

Physical sales tax nexus in New York

Physical nexus refers to a business’s tangible presence within a state. Examples of physical presence in New York include having a store, office, warehouse, or employees working in the state. When a business has physical nexus in New York, it is required to collect and remit sales tax on sales made within the state regardless of how often or how much is sold.

Economic sales tax nexus in New York

On the flip side, economic nexus focuses on a business’s financial activities with a state. In New York, this connection is formed when a remote seller generates over $500,000 in sales and completes more than 100 transactions within the state during the previous four quarters. New York’s sales tax quarters are:

- March 1 – May 31

- June 1 – August 31

- September 1 – November 30

- December 1 – February 28/29

Notably, New York’s approach to economic thresholds is slightly different from other states. While most states require businesses to exceed just one threshold, New York mandates remote businesses with no physical nexus to surpass both thresholds before they become responsible for sales and use tax collection and remittance.

Determining nexus for your business can be a complex and daunting task. With many factors to consider, businesses struggle to navigate the intricacies of nexus determination, and even end up paying thousands of dollars to accounting firms to get answers. That’s why we offer nexus determination as an a-la-carte or package deal for businesses at affordable prices. With over 20 years of experience in federal and state tax and accounting laws, we’re a trusted partner for many businesses in need of nexus review services. Contact us now for a consultation!

Are marketplace facilitators required to collect and remit sales tax in New York?

In the Empire State, marketplace facilitator laws require facilitators to collect and remit sales tax on behalf of their sellers, but only if they meet specific economic thresholds. Designed to promote tax compliance and simplify the collection process, these laws apply when a facilitator’s cumulative gross sales and transactions surpass the same economic thresholds set for remote retailers. However, this only covers sales of tangible personal property (physical goods) and prewritten computer software.

For remote sellers exclusively using marketplace facilitators and lacking a physical presence in New York, there’s no sales tax responsibility. But if a remote seller also sells through other platforms, like a website or telecommunication sales, they must tally their taxable gross receipts and transactions from all sources—including the facilitator—to determine whether they need to register with New York for sales tax collection and remittance.

What platforms are marketplace facilitators?

What is a marketplace facilitator?

A marketplace facilitator, sometimes referred to as a Multivendor Marketplace Platform (MMP), is an online platform that allows customers to purchase goods or services from various vendors in one convenient location. These platforms can benefit businesses by increasing product visibility and attracting a larger customer base. Additionally, marketplace facilitators often have the legal responsibility to collect and remit sales tax on behalf of sellers, which can help ease the sales tax burden for businesses.

Filing New York Sales Tax

Ready to start collecting sales tax in New York? Your next step is to register with the state for a Certificate of Authority. This can only be done online using the New York State Business Express. Once you have your certificate, you’re all set to start collecting sales tax from your customers.

Now, how often you will need to file depends upon your business’s taxable sales (more on that later). When it’s time to file your sales tax returns, you will need to do so on New York’s Sales Tax Web File. Make sure to register for an account ahead of time to avoid any last-minute hiccups.

A few more things to keep in mind:

- Always file a return for each period, even if you don’t owe any sales tax or have no gross receipts to report.

- It’s a smart idea to open and maintain a separate bank account for sales tax receipts.

- Remember to never use the sales tax money you collect to make other purchases or pay any other expenses besides sales tax remittance.

- Hold onto all your sales tax records for at least three years just in case you get audited.

Let us file for you!

If you’re looking for help with a myriad of sales tax obligations, that’s why we’re here! We are a one-stop-shop for comprehensive sales tax services! Our range of services includes nexus determination, business registration, compliance reviews, audit assistance, and—of course—filing sales and use tax returns. If you don’t see what you need, just let us know and we’ll create a customized solution just for you. Visit our services page to learn more!

When are sales tax returns due in New York?

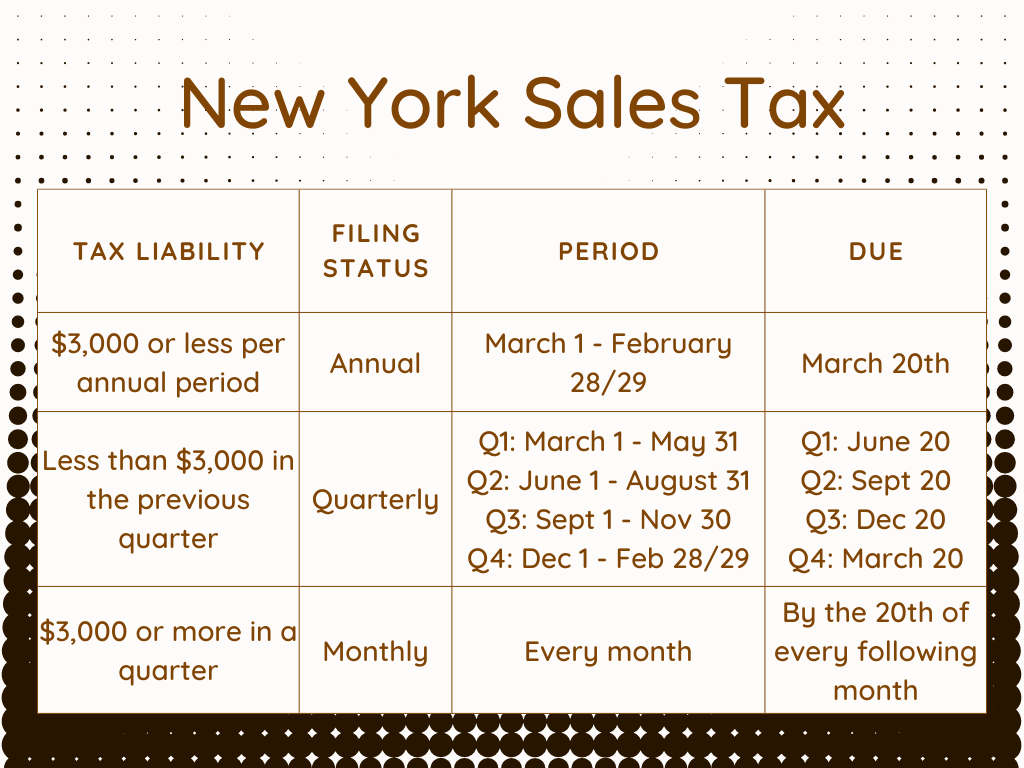

When you register for sales tax in New York, you’ll be assigned one of three filing frequencies: monthly, quarterly, or annually. Your filing frequency is determined by the total taxable receipts your business reports during registration. The more sales you make, the more often you’ll need to file.

No matter your filing frequency, New York sales tax returns are due by the 20th day of the month following a reporting period. If the 20th falls on a weekend or federal holiday, the due date shifts to the next business day. Check out our handy graphic below for a breakdown of filing frequencies and their due dates, and keep in mind that New York’s quarterly periods are different from other states!