Do you need to collect and remit sales tax in North Carolina?

Sales and use tax in North Carolina applies to the retail sale, lease, or rental of tangible personal property, as well as certain digital property and services. Typically, doing business in North Carolina constitutes the need to collect and remit sales tax, with some exemptions. For example, if a remote seller is located outside the state and has no physical location or employees within NC, they may not need to collect and remit sales tax unless their gross sales or transactions surpass a set threshold. Additionally, some items and services are exempt from sales tax. Here are a few examples:

- Agricultural machinery

- Prosthetics

- Prescription drugs

Do you have sales tax nexus in North Carolina?

Sales tax nexus is one of the most crucial concepts for businesses to understand, as it determines whether a business is required to collect and remit sales tax in a state. Sales tax nexus refers to the connection between a business and the state, which may result from either a physical presence or an economic presence in North Carolina.

Physical sales tax nexus in North Carolina

Physical nexus is established when a business has a tangible presence in the state, such as a brick-and-mortar store, office, warehouse, or employees working within the state. Businesses with physical nexus are engaged in business with the state, regardless of their gross proceeds. Even seasonal businesses are required to register with North Carolina to collect and remit sales tax. Other examples of physical nexus in the state include:

- Having a representative, agent, or solicitor operating or creating business in the state

- Attending an event or function in the state for the purpose of making sales

- Selling at flea markets or other events in the state

Economic sales tax nexus in North Carolina

Economic nexus is a new (since 2018) requirement that applies to remote sellers or any business that does not have physical presence but sells into a state. Unlike businesses with physical nexus, remote sellers need not register to collect and remit sales tax unless they exceed certain thresholds. The thresholds set by North Carolina for remote sellers are:

- Exceeding $100,000 of gross sales sourced to North Carolina in the current or previous calendar year.

- 200 or more separate North Carolina transactions in the previous or current calendar year.

These thresholds include all combined sales sourced to North Carolina, even those that may be nontaxable or made through a marketplace facilitator.

Determining nexus for your business can be a complex and daunting task. With many factors to consider, businesses struggle to navigate the intricacies of nexus determination, and even end up paying thousands of dollars to accounting firms to get answers. That’s why we offer nexus determination as an a-la-carte or package deal for businesses at affordable prices. With over 20 years of experience in federal and state tax and accounting laws, we’re a trusted partner for many businesses in need of nexus review services. Contact us now for a consultation!

Are marketplace facilitators required to collect and remit sales tax in North Carolina?

In North Carolina, marketplace facilitators are required to collect and remit sales tax on behalf of their marketplace sellers if they are engaged in business in the state. A facilitator is engaged in business in North Carolina if they exceed either of the two economic nexus thresholds set for all remote retailers. This requirement applies regardless of whether the seller has a physical presence in the state, is registered as a retailer, or would have been required to collect and remit sales tax if the sales had not been made through the marketplace.

Conversely, if a marketplace seller uses a facilitator that does not have nexus in North Carolina, the seller is then responsible for collecting and remitting sales tax.

What platforms are marketplace facilitators?

What is a marketplace facilitator?

A marketplace facilitator, sometimes referred to as a Multivendor Marketplace Platform (MMP), is an online platform that allows customers to purchase goods or services from various vendors in one convenient location. These platforms can benefit businesses by increasing product visibility and attracting a larger customer base. Additionally, marketplace facilitators often have the legal responsibility to collect and remit sales tax on behalf of sellers, which can help ease the sales tax burden for businesses.

Filing North Carolina Sales Tax

If you need to start collecting and remitting North Carolina sales tax, you will need to take the right steps to ensure compliance and peace of mind. Refer to this table for a breakdown of the process:

| Section | Content |

| 1. Perform a nexus review | Compile your North Carolina gross sales and determine whether you have exceeded either of the economic thresholds in the state. If you would feel more comfortable outsourcing this task, there are many tax services that provide nexus studies as a service, (including us!) |

| 2. Register for a sales and use tax number | New businesses can register for a sales tax number online via North Carolina’s online business registration or by submitting a paper application (Form NC-BR). Businesses will need to supply information such as business name, address, EIN or SSN, and details about the business activities. Most applicants that register online receive their account number instantly, while paper applications may take up to four weeks. |

| 3. Collect sales tax | If you are shipping items, collect sales tax based on the destination of the item. Different jurisdictions in North Carolina have different sales tax rates, so you will need to know these rates and collect based on the destination zip code. |

| 4. File and Remit Sales Tax | Sales tax returns can be filed and remitted online or by submitting a paper return (Form E-500). File these returns based on your filing frequency (more on this later). Additionally, a return must be filed for each period even if no tax is due. |

| 5. Maintain accurate records | Keep your tax records for a minimum of three years in case of an audit. |

Let us file for you!

If filing sales tax returns is too overwhelming or time-consuming, you’re not alone. Running a business is demanding work and filing tax returns can be a pain, especially when you need to keep up with all the different rules and regulations. We at SalesTaxSolutions.US are here to make things easier! As a company, we help businesses like yours deal with the many state-by-state regulations and file your sales tax returns for you. We’ve got 20 plus years of knowledge and experience to help you get back to saving time and making money as soon as possible. Message, email or call us at 888-544-7730 for a free quote today!

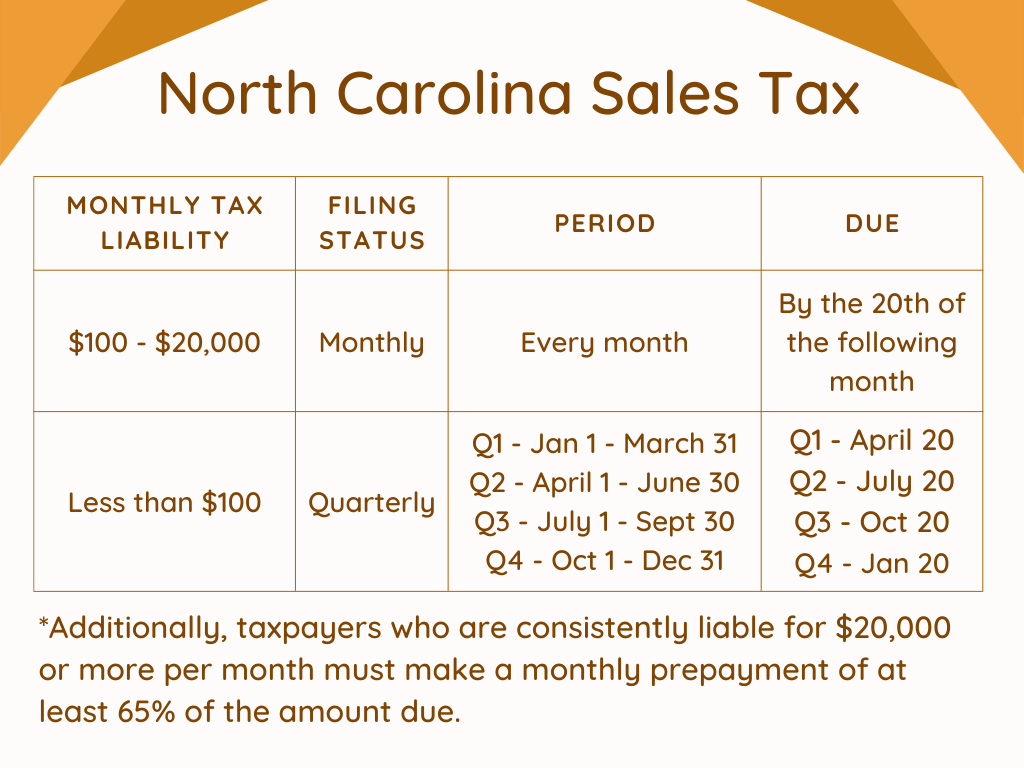

When are sales tax returns due in North Carolina?

Filing frequencies for sales tax refer to the regular intervals at which businesses are required to file and remit sales tax to the state. In North Carolina, filing frequencies can be monthly or quarterly, depending on the amount of sales tax liability a business has. Check out the graphic below for a detailed look at these filing frequencies, their due dates, and what tax liability they correspond with.