Do you need to collect and remit sales tax in Oklahoma?

If you’re a business or retailer selling tangible personal property on an ongoing basis in Oklahoma, it’s essential to register with the Oklahoma Tax Commission and obtain a business sales tax permit. Tangible personal property includes anything that can be seen, weighed, measured, felt, or touched, as well as anything perceptible to the senses. In Oklahoma, this definition also covers electricity, water, gas, steam, and prewritten computer software.

But don’t worry, there are some exemptions to keep in mind. Sales for resale, transactions involving charitable health organizations, sales made to and by churches, museum admissions and purchases, and sales to governmental entities are all tax-free. Additionally, 100% disabled veterans can apply to be exempt from Oklahoma sales tax up to $25,000 per year.

Do you have sales tax nexus in Oklahoma?

Sales tax nexus determines whether a company must collect and remit sales tax in a particular state. As with most state, Oklahoma imposes two types of nexus: physical and economic.

Physical sales tax nexus in Oklahoma

Physical nexus is established when a business has a tangible presence in Oklahoma. Examples of this include:

- Storefronts

- Offices

- Warehouses

- Employees in the state

- Using third-party affiliates to promote or facilitate sales

In contrast to economic nexus—which targets remote sellers—businesses with a physical presence in Oklahoma must collect and remit sales tax on all transactions, regardless of their sales volume. However, there are a few exceptions to this rule:

- If the business holds a valid Oklahoma exemption permit.

- If the sale is made to a customer with an exemption permit.

- If the transaction occurs during a designated sales tax holiday.

Economic sales tax nexus in Oklahoma

Following the South Dakota v. Wayfair decision, many states, including Oklahoma, introduced economic nexus laws to create a more equitable business environment. These laws set specific thresholds for sales or transaction volumes that, when exceeded by a remote seller, create an obligation to collect and remit sales tax in the state. This approach ensures that all sellers, whether remote or in-state, adhere to the same sales tax regulations.

In Oklahoma, economic nexus targets remote sellers without a physical presence in the state, but who still deliver taxable products or services within its borders.

Oklahoma’s economic nexus laws come into effect when a remote seller:

- Surpasses $100,000 in taxable Oklahoma sales in the previous or current calendar year.

Are marketplace facilitators required to collect and remit sales tax in Oklahoma?

As ecommerce continues to thrive, marketplace facilitators have become increasingly important in managing sales tax collection and remittance. In Oklahoma, if a marketplace facilitator’s combined sales within the state over the past 12 months meet or exceed $10,000, they are responsible for collecting and remitting sales tax on behalf of the sellers they work with.

Remote sellers who only use a registered marketplace facilitator don’t have to worry about sales tax obligations in the state. However, if they also sell through their own website or multiple platforms in addition to the marketplace facilitator, they’ll need to assess whether their combined taxable Oklahoma sales, (excluding those made through the facilitator), surpass the economic threshold.

What platforms are marketplace facilitators?

What is a marketplace facilitator?

A marketplace facilitator, sometimes referred to as a Multivendor Marketplace Platform (MMP), is an online platform that allows customers to purchase goods or services from various vendors in one convenient location. These platforms can benefit businesses by increasing product visibility and attracting a larger customer base. Additionally, marketplace facilitators often have the legal responsibility to collect and remit sales tax on behalf of sellers, which can help ease the sales tax burden for businesses.

Filing Oklahoma Sales Tax

If you have sales tax nexus in Oklahoma, you might be wondering: what’s my next step? Follow the guidelines below for instructions on how to register for an Oklahoma sales tax permit, calculate sales tax rates, file sales tax returns, and maintain proper recordkeeping.

Registering for an Oklahoma Sales Tax Permit

- Gather necessary documents, including your FEIN, business information, and other relevant details.

- You can register for a sales tax permit on the Oklahoma Tax Commission website (OkTAP). Or, if you need to register in multiple states, you can visit the Streamlined Sales Tax Registration System and submit a single application for all or any of their 23 registered states.

- Complete either of the above applications and wait for confirmation from the Oklahoma Tax Commission.

Calculating Oklahoma Sales Tax Rates

- Oklahoma’s state sales and use tax rate is 4.5%. Local taxes may apply in some areas and will be added onto the state tax rate. You can find the current rates here.

- Some software vendors also provide sales tax calculation. Additionally, sellers that register with Streamlined Sales Tax may qualify for free sales tax calculation and reporting services.

Filing Oklahoma Sales Tax Returns

- For most sales taxpayers, returns must be submitted monthly. This depends upon monthly sales tax liability, (which we will cover more below).

- You can file your Oklahoma sales tax returns one of two ways:

- Filling out and submitting Form STS-20002-A, postmarked and paid by the due date.

- Creating and signing into an OkTAP account and filing the returns online (recommended).

Other Important Notes and Recordkeeping Requirements

- Be aware of penalties for late or incorrect filing. Remember that a return for each period must be filed even if there is no tax due.

- Maintain accurate records of all sales tax transactions, including invoices, receipts, and exemption certificates.

- Retain records for a minimum of three years in case of an audit.

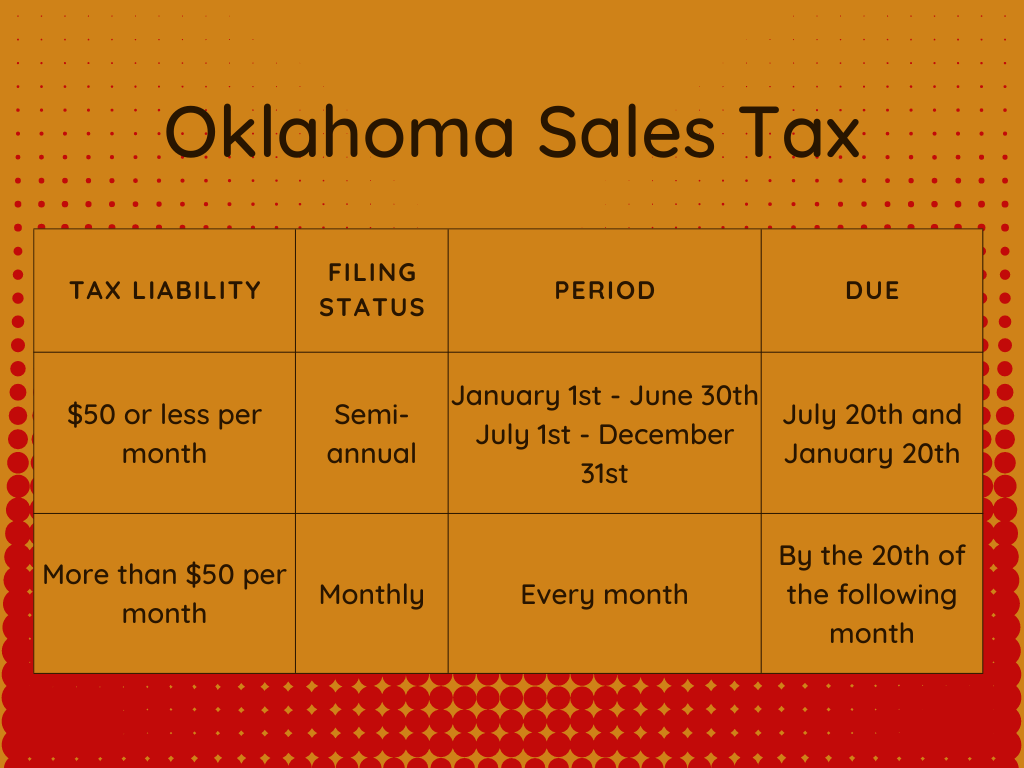

When are sales tax returns due in Oklahoma?

The due dates for sales tax returns depend on a business’s assigned filing frequency, which is determined by its average monthly sales tax liability. Most taxpayers fall under the monthly filing frequency category, meaning they need to file sales tax returns every month. However, vendors with lower sales tax remittance may qualify for a semi-annual filing frequency, allowing them to file only twice a year. If a sales tax due date falls on Saturday, Sunday, or an observed state holiday, the return and payment are due by the next business day. Check out the graphic below to better understand Oklahoma’s filing frequencies.