Do you need to collect and remit sales tax in Rhode Island?

Sales tax is a levy imposed on the retail sale, rental, or lease of many goods and services. In Rhode Island, it is the responsibility of the retailer to collect this tax from their customers. However, there are certain exemptions to sales tax collection in the state. For instance, sales for resale (such as through a wholesaler), transactions involving charitable or religious organizations, manufacturers, farmers, government entities, newspapers, school meals, medicines, drugs, and durable medical equipment are all exempt from sales tax.

In addition to the general sales tax, Rhode Island applies a Local Meals and Beverage tax to eating and/or drinking establishments at an additional 1% rate. Furthermore, there is a 6% hotel tax on the rental of rooms in hotels, motels, or lodging houses.

If you have a business that sells taxable products or services, it is necessary to register to collect sales tax before you start your operations. This excludes remote or internet retailers, who are only required to collect sales tax once they exceed certain economic thresholds.

Do you have sales tax nexus in Rhode Island?

If you’re wondering when you need to collect and remit sales tax, understanding nexus is crucial. Sales tax nexus is the connection a seller or business has with a state that makes it liable for sales tax collection and remittance. This nexus comes in two forms: physical and economic.

Physical sales tax nexus in Rhode Island

Physical nexus is established when a business has a tangible presence in Rhode Island, such as:

- A store

- A warehouse

- Offices

- Having an employee, contractor, salesperson, or other representative present in the state

- Regular advertising in newspapers, billboards, or other similar advertising materials

- Solicitation of sales through telephone, television, or radio

If a business has physical nexus in Rhode Island and makes taxable sales, it is required to register with the Rhode Island Division of Taxation regardless of sales volume.

Economic sales tax nexus in Rhode Island

Economic nexus is created when a business that has no physical presence or location in Rhode Island exceeds set sales and transaction thresholds. This rule is set to balance the collection of sales tax in response to increased internet sales.

The economic nexus thresholds in Rhode Island apply to the previous year. They are:

- Gross revenue from Rhode Island sales of $100,000 or more

- Rhode Island sales in 200 or more separate transactions

A remote seller only needs to meet one of these thresholds before being required to collect and remit sales tax.

Are marketplace facilitators required to collect and remit sales tax in Rhode Island?

In Rhode Island, Marketplace facilitators adhere to the same economic nexus laws as other remote retailers. They are responsible for collecting and remitting sales tax if they meet or exceed $100,000 in Rhode Island sales or complete 200 Rhode Island transactions within the previous year. When a marketplace facilitator meets either of these thresholds, they must collect and remit sales tax on behalf of the sellers who use their platforms, regardless of whether the individual seller would have been required to collect tax or holds a permit.

Sellers who exclusively make sales through a marketplace facilitator that has nexus are not responsible for sales tax collection. However, sales made through additional sources like websites or another non-marketplace facilitator platforms, such as BigCommerce or NetSuite, will need to be calculated into a nexus determination.

What platforms are marketplace facilitators?

What is a marketplace facilitator?

A marketplace facilitator, sometimes referred to as a Multivendor Marketplace Platform (MMP), is an online platform that allows customers to purchase goods or services from various vendors in one convenient location. These platforms can benefit businesses by increasing product visibility and attracting a larger customer base. Additionally, marketplace facilitators often have the legal responsibility to collect and remit sales tax on behalf of sellers, which can help ease the sales tax burden for businesses.

Filing Rhode Island Sales Tax

Filing Rhode Island sales tax returns begins with registering your business. There are three ways to do this:

| Online | The Division of Taxation recommends that all taxpayers who can register, file, and pay electronically do so. This is mandatory in some cases. Online registration can be done through the Division’s Taxpayer Portal. |

| BAR Form | Complete and submit the BAR form to [email protected] or [email protected]. |

| Streamlined Sales Tax | Register online through the Streamlined Sales and Use Tax Governing Board website. Through the Streamlined option, you may register with any or all the Streamlined member states, including Rhode Island. |

After registration, you will receive your sales tax permit and can begin collecting sales tax. Note that sales tax permits expire every June 30th and renewal applications are due annually by February 1st.

Generally, retailers are required to file monthly, (more on this later), and report all sales and sales tax collected in the previous month. All sales tax collected from Rhode Island customers is considered Trust Fund Tax, meaning that is it a fund for the state until paid and must be held separately from sales receipts or other income.

Once your collection period is up, you can file your sales tax returns one of two ways:

| Online | The easiest and most accurate option is electronic filing. Larger businesses whose combined annual liability for Rhode Island taxes meets or exceeds $5,000, or businesses whose annual gross income is over $100,000 are required to file and remit online. Online filings and payments are done through Rhode Island’s tax portal, where you will need to have an account. |

| Paper Form | Businesses that are not required to file electronically do have the option to complete and mail Form RI-STR. |

Remember that you must still file a sales tax return, even if you have no tax or sales to report!

Let us file for you!

If you’re looking for help with a myriad of sales tax obligations, that’s why we’re here! We are a one-stop-shop for comprehensive sales tax services! Our range of services includes nexus determination, business registration, compliance reviews, audit assistance, and—of course—filing sales and use tax returns. If you don’t see what you need, just let us know and we’ll create a customized solution just for you. Visit our services page to learn more!

When are sales tax returns due in Rhode Island?

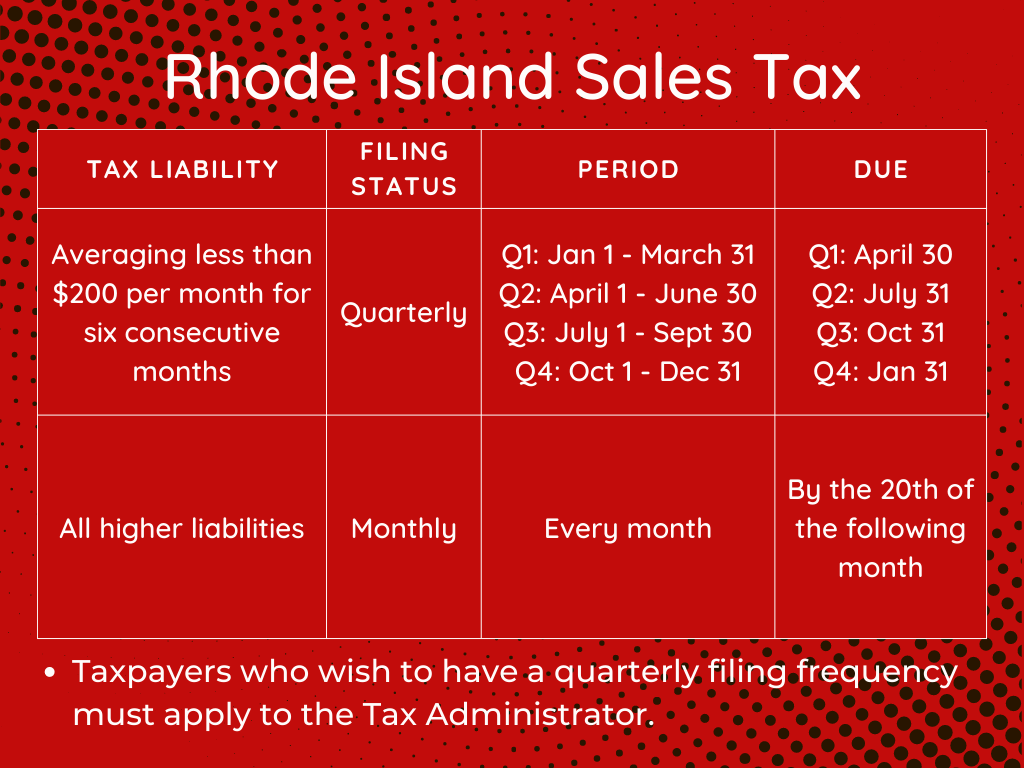

Unless otherwise approved, taxpayers must file and remit sales tax returns monthly. The graphic below details the due dates for returns, as well as in what instance a quarterly filing frequency can be requested.