Do you need to collect and remit sales tax in Vermont?

Like many states, Vermont taxes the sale of tangible personal property unless specifically exempted. What falls under tangible personal property? This tax term applies to everyday items like furniture, appliances, clothes, and tools. However, every rule has its exceptions.

A few items that are not taxable in Vermont include:

- Medical equipment and supplies.

- Menstrual care products.

- OTC drugs.

- Food items and beverages, excluding soft drinks.

- Many essential clothing items, such as coats, jackets, diapers, shoes, underwear, and uniforms.

Certain organizations are also exempt from sales tax, including nonprofits, religious organizations, schools, Veterans organizations, and more.

But just because these entities bypass sales tax doesn’t mean they escape all taxes. Vermont has a unique form of tax called the “Rooms and Meals tax”, which many of these exempted entities still have to pay. For instance, if a nonprofit’s staff attends a conference, stays in a hotel, and dines out, they must pay the Meals and Rooms tax on these services.

Do you have sales tax nexus in Vermont?

Understanding sales tax nexus is the foundation of sales tax compliance. There are typically two types of nexus: Physical and Economic. However, Vermont enforces an additional nexus type called Click-Through Nexus. We dive into each category below.

Physical sales tax nexus in Vermont

A business has physical nexus in Vermont if it maintains a physical presence in the state. This could be in the form of an office, staff, warehouse, or even a single sales representative. Essentially, if your business has any tangible presence within Vermont’s borders, it falls under the physical nexus umbrella.

Businesses with physical nexus, unless otherwise exempt, are required to collect and remit sales tax regardless of sales or transaction volume.

Economic sales tax nexus in Vermont

Economic nexus focuses on sales revenue and transactions instead of physical presence. As a result of the 2018 U.S. Supreme Court decision in South Dakota v. Wayfair, Vermont adopted economic nexus laws. This means that businesses or sellers with no physical presence in the state that make at least $100,000 in sales or 200 individual transactions in Vermont within the preceding 12-months have economic nexus. All Vermont sales, even nontaxable ones, count toward this economic nexus determination.

A secondary economic nexus law that applies to remote sellers is click-through nexus. If a Vermont resident agrees to refer customers to a remote seller and that seller subsequently makes more than $10,000 in taxable Vermont sales, that business now has click-through nexus.

Are marketplace facilitators required to collect and remit sales tax in Vermont?

Since June 1, 2019, marketplace facilitators have been required to collect and remit sales tax on retail sales made through their platforms. These facilitators must inform sellers that they will handle the collection and remittance of sales tax on their behalf. So good news you sell to Vermont residents through a facilitator; there’s no need to worry about tax on those sales!

However, keep in mind that remote retailers selling through multiple platforms, including marketplace facilitators, must combine their total Vermont sales and transactions to determine nexus. This includes:

- Taxable and nontaxable sales

- Sales made through a facilitator

- All transactions sourced to the state

What platforms are marketplace facilitators?

What is a marketplace facilitator?

A marketplace facilitator, sometimes referred to as a Multivendor Marketplace Platform (MMP), is an online platform that allows customers to purchase goods or services from various vendors in one convenient location. These platforms can benefit businesses by increasing product visibility and attracting a larger customer base. Additionally, marketplace facilitators often have the legal responsibility to collect and remit sales tax on behalf of sellers, which can help ease the sales tax burden for businesses.

Filing Vermont Sales Tax

If you have nexus in Vermont, you will need to register your business with the Vermont Department of Taxes before you can start collecting sales tax. This can be conveniently done via Vermont’s online business service center or by mailing or faxing Form BR-400. After registering you will be issued a sales and use tax license, enabling you to collect and remit sales tax.

Another method of registration is through the streamlined sales tax project, which is an initiative aimed at simplifying and modernizing sales and use taxes for remote sellers. Along with Vermont, 23 other states are members. For businesses that need to register for sales tax in multiple states, Streamlined Sales Tax can be a helpful tool; only one application is needed to register for any or all member states. However, this resource is only for registration purposes; returns must still be filed on myVTax or with a paper form.

The Vermont Department of Taxes will also assign you a filing frequency upon registration, (we will discuss this in further detail in the next section). Once you have collected sales tax for your assigned period, you have two filing options:

- Online: Vermont strongly advocates that taxpayers use their electronic filing system, myVTax. This method is the fastest, easiest, and most accurate method of filing. Businesses with multiple locations and those with total sales and use tax remittance exceeding $100,000 in the previous year are required to file and pay online.

- Paper: Businesses that do not fall under one of the above categories still have the option to file using paper Form SUT-451.

Now that you know the steps to take toward filing your Vermont sales tax returns, here are some other best practices to keep in mind:

- Keep accurate and thorough sales tax records for at least three years in case of an audit. This includes sales tax and any exemption certificates you receive from buyers.

- Separate the sales tax you collect from business income. Sales tax should not be classified as income and should never be used to make other purchases or pay other expenses besides tax remittance.

- Stay updated. Sales tax laws and especially rates change often.

When are sales tax returns due in Vermont?

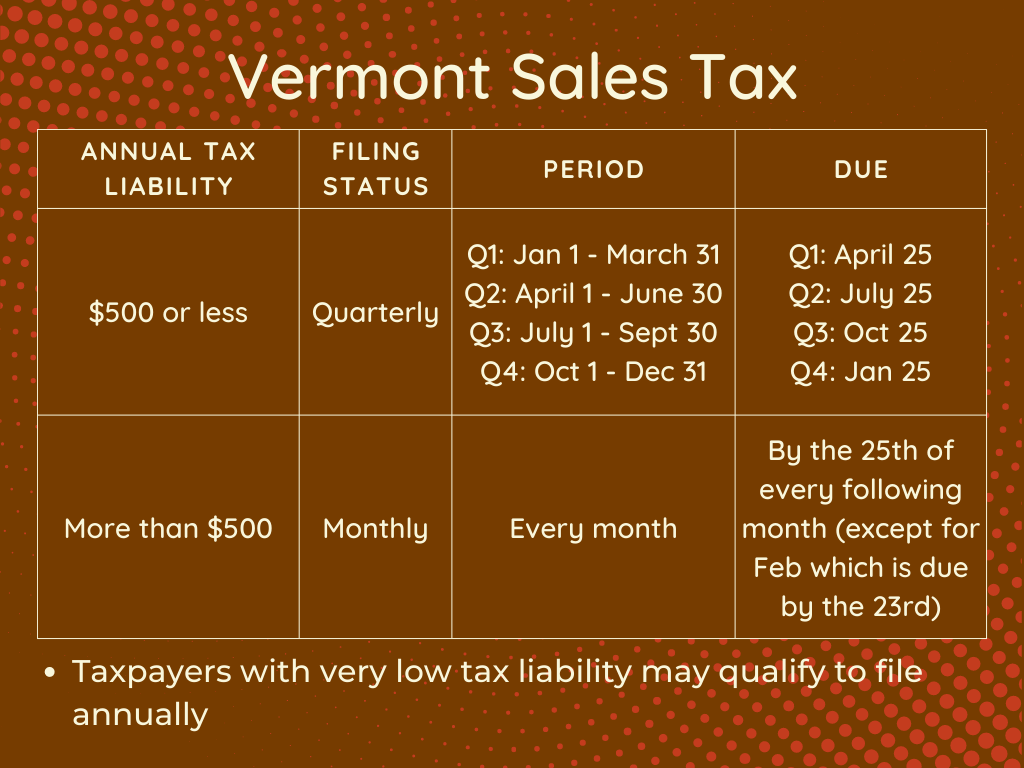

Upon registration, Vermont chooses a filing frequency for each sales taxpayer based on the estimated annual tax liability. The due date extends to the next working day if it falls on a weekend or holiday. Refer to the graphic below for a breakdown of Vermont’s filing frequencies and due dates.