Do you need to collect and remit sales tax in West Virginia?

Do you make sales in West Virginia? If so, you’ll likely need to collect sales tax.

Vendors or businesses in West Virginia who sell or lease tangible personal property or provide a service are required to collect sales tax unless an exception applies. This also extends to remote sellers not located in West Virginia, who may need to collect and remit sales tax if their sales or transaction count into the state exceeds specific thresholds.

There are two cases in which a seller will not need to collect sales tax:

- If the purchase is recognized by the state as non-taxable.

- If a customer presents an authorized exemption certificate at the time of sale.

Some examples of sales and services that are non-taxable across the state include:

- Advertising

- Day care services

- Prescription drugs and durable medical goods

- Exempt organizations, such as credit unions, regional transit authorities, county ambulance organizations, and others

- Lottery tickets

Do you have sales tax nexus in West Virginia?

In the era before ecommerce dominated, sales tax nexus was not a critical component of the sales tax machinery. However, the surge of ecommerce has brought many changes in business structures, accompanied by a tremendous increase in internet sales. As a result, nexus now forms the cornerstone of sales tax collection.

In West Virginia, there exist two principal types of nexus—physical and economic. Let’s take a look at both.

Physical sales tax nexus in West Virginia

Physical nexus revolves around the concept of physical presence. For businesses in West Virginia, this takes the form of retail stores, warehouses, and even extends to the regular presence of traveling salespeople or representatives within the state. Storing inventory in West Virginia can also constitute having physical nexus.

Economic sales tax nexus in West Virginia

While physical nexus has been a longstanding concept, economic nexus is a relatively recent development. To even out the sales tax landscape and ensure proper revenue collection, most states have implemented economic nexus laws. This type of nexus targets out-of-state or remote sellers who lack a physical presence in a state but still generate significant sales from its residents.

West Virginia employs economic nexus thresholds to establish which businesses are required to register for sales tax collection. These criteria are:

- Gross receipts exceeding $100,000 from sales to West Virginia in the previous or current calendar year

- 200 or more transactions for sales delivered within West Virginia in the previous or current calendar year

A business need only meet one of these two thresholds to become responsible for sales tax collection and remittance.

Are marketplace facilitators required to collect and remit sales tax in West Virginia?

Yes, marketplace facilitators have the responsibility of collecting and remitting sales and use taxes on behalf of their platform’s sellers, albeit if they exceed the economic nexus thresholds. Facilitators must combine the total West Virginia sales across their platform—both taxable and nontaxable—to determine if they have economic nexus. However, an important note to remember is that a facilitator dealing exclusively in non-taxable sales does not need to register for sales tax collection.

Retailers who confine their remote operations solely through a marketplace facilitator and do not have a physical footprint in West Virginia are in luck; they aren’t required to register with the state and collect sales tax. On the other hand, multi-platform sellers—including those working through facilitators—will need to tally all gross sales and transactions sourced to West Virginia to decide if they’ve established an economic nexus.

What platforms are marketplace facilitators?

What is a marketplace facilitator?

A marketplace facilitator, sometimes referred to as a Multivendor Marketplace Platform (MMP), is an online platform that allows customers to purchase goods or services from various vendors in one convenient location. These platforms can benefit businesses by increasing product visibility and attracting a larger customer base. Additionally, marketplace facilitators often have the legal responsibility to collect and remit sales tax on behalf of sellers, which can help ease the sales tax burden for businesses.

Filing West Virginia Sales Tax

Before collecting sales tax, it is mandatory for all individuals and business entities to secure a West Virginia Business Registration Certificate from the state’s tax department. Please refer to the table below for the different registration methods.

| Registration Method | Who It’s For | Information | Links |

| Online Registration | All Businesses | The best option for fast processing and ease of use for all business types. | West Virginia One Stop Business Portal |

| Paper Registration | All Businesses | The traditional method. Not encouraged for remote sellers. | WV BUS-APP |

| Streamlined Sales Tax | Remote Sellers or Marketplace Facilitators | For out-of-state retailers or facilitators who need to register with multiple states at once. | Streamlined Sales Tax Registration System |

After processing a registration, West Virginia provides the taxpayer with a business license and filing information. Then, sales tax collection begins.

West Virginia’s sales tax system operates on a destination-based principle. This means sales tax is collected based on the location where the purchase is received. Under this system, when sellers process transactions they must apply the sales tax rate based on their location, (if the customer comes to them to receive the purchase), or the delivery destination. This includes not only the state’s general sales tax rate but also applicable local taxes.

When it comes time to file, you have a few options which we’ve outlined in the table below.

| Filing Method | Details | Useful Links |

| Online Filing | The West Virginia Tax Department encourages all taxpayers to file and pay electronically using their MyTaxes online system. In fact, taxpayers paying more than $25,000 in the prior tax year are required to file and pay online. To file on MyTaxes, you will need to create an account and link it to your registered business. | MyTaxes Filing Instructions |

| Paper Filing | West Virginia still allows the use of paper filing to report or amend both state and municipal sales and use taxes. Paper returns and payment checks must be mailed by the due date. | CST-200CU Filing Instructions |

| SalesTaxSolutions.US | We offer an efficient and reliable choice for businesses in need of sales tax filing services. With our customized systems, we not only ensure correct tax collection but also automate sales tax reporting to help you meet all the deadlines. | Contact Us Our Services |

When are sales tax returns due in West Virginia?

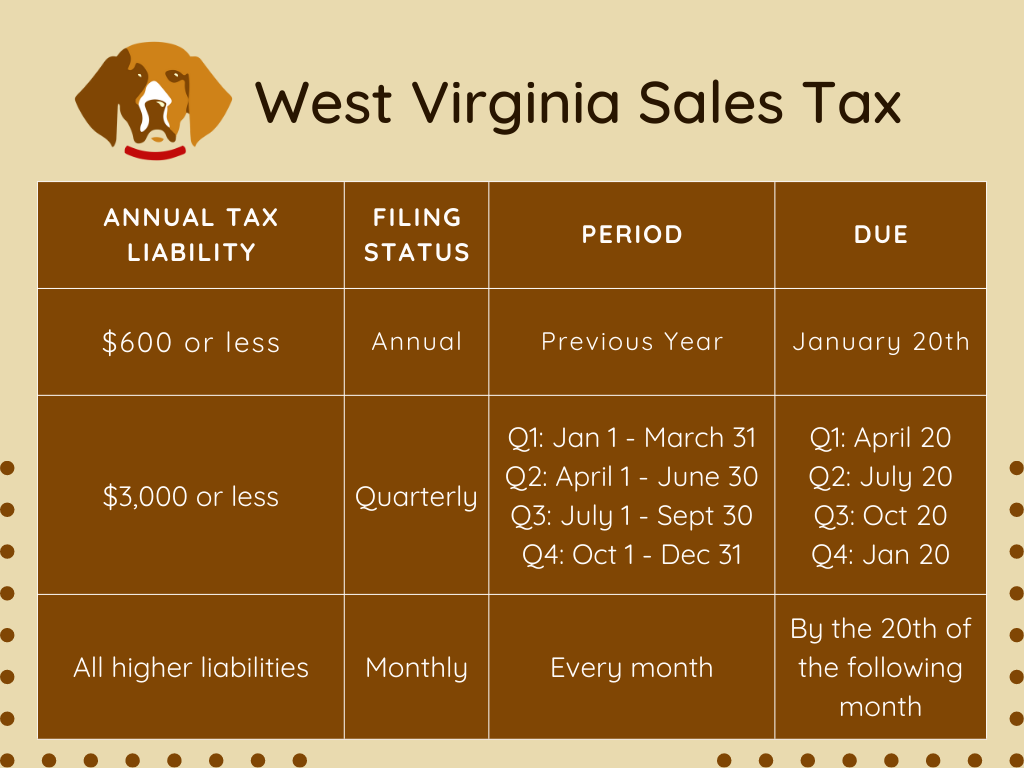

Each taxpayer in West Virginia is given a specific filing frequency upon registration. This frequency informs them of their filing timeline, including the frequency of filing, due dates for returns, and the specific period each return should cover. While most taxpayers are assigned a monthly filing frequency, two other frequencies—quarterly and annually—exist, which are based on annual sales tax remittance. See the graphic below for a comprehensive breakdown.