NetSuite Sales Tax

Get to know NetSuite sales tax basics

NetSuite is a Cloud ERP (Enterprise Resource Planning) software with more than 33,000 worldwide customers. It is rich with different products and features suitable for any business, from the startups to the global-scale corporations. On the sales tax side of things, look to SuiteTax, a configurable tax engine for global tax management that is included with a NetSuite platform license. According to NetSuite, SuiteTax saves time, reduces costs and eliminates the need for manual calculations.

However, SuiteTax is an optional plug-in for NetSuite users, and sales tax reporting is still possible using Tax Management within the main software. Read on for more information on how to calculate and report sales tax with NetSuite.

Sales Tax Overview

Marketplace Responsibility

Some online platforms used for selling products are considered Marketplace Facilitators. This means that the platform is responsible for collecting and remitting sales tax. This removes the responsibility to collect and remit sales tax as a seller on those platforms. NetSuite is not a Marketplace Facilitator, so the sellers on this platform must collect and remit sales taxes.

Seller Responsibility

First things first, before enabling tax collection for an online store it is important to evaluate where you have sales tax nexus and whether your products are taxable in those jurisdictions.

Steps to Collecting Sales Tax:

- Complete a thorough sales tax nexus review for both physical nexus and economic nexus.

- Register necessary sales tax account.

- Obtain sales tax certificates.

- Enable sales tax collection on all required platforms for the registered jurisdictions.

- File sales tax returns and maintain sales tax account.

SuiteTax:

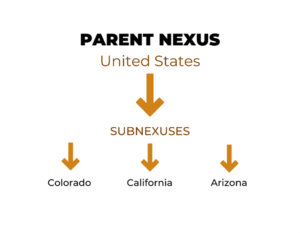

If you choose to use the SuiteTax plugin, you will need to set up a hierarchy of nexuses (tax jurisdictions). SuiteTax uses a model like a Family Tree for each business and its subsidiaries to determine the correct tax rate on transactions. For example, the United States would be a Parent Nexus, and each states you have jurisdiction in would be a Subnexus.

As SuiteTax automatically provides monthly tax rate updates for your jurisdictions and applies it to transactions, using their model can make tax reporting easier. Nexuses can be inactivated at any point; just make sure you no longer have sales to report in that area.

NetSuite Tax Management:

With the standard Tax Management software, the process of adding nexus depends upon whether you have the Advanced Taxes feature enabled. However, there are two steps required for both before a nexus can be added:

- A user must first set up a Tax Agency (or Vendor Record). After this has been done, a Tax Code, (which is how much tax is applied to each sold item based upon a customer’s geographic area, the type of transaction and the tax rate for the location), will need to be applied to that Tax Agency. These first two steps provide the information needed to accurately account for taxes in a nexus.

You can click here for more instructions toward adding nexus on NetSuite. Once you have added a state the nexus has been created, and you can move on to accurate sales tax collection.

Sales Tax Collection

As we now know, NetSuite sales tax collection differs depending upon the use of the SuiteTax plugin, Advanced Tax features and basic NetSuite Tax Management software.

SuiteTax automates the process by updating ever-changing sales and use tax rates for each nexus on a monthly basis, providing tax rates, tax codes, tax groups and tax agencies, integrating with NetSuite SuiteCommerce and more to simplify tax collection.

With Advanced Tax Features and accounts without those features, users are required to do more manual setup and calculations. However, you can integrate NetSuite with third-party applications such as Avalara AvaTax, Vertex, and Thomson Reuter to handle the tax calculation for you. This can make it easier to collect and remit, while also reducing range of error.

The decision of how to handle sales tax collection is personal and unique to every online retailer. The many different features and plugins available on NetSuite make for a wide breadth of options, but it can also be overwhelming. Your best configuration for your business will have everything to do with the products you sell, how many jurisdictions you have nexus in and your budget.

Sales Tax Reports

SuiteTax:

When viewing and pulling sales tax reports, SuiteTax uses a filter page. With the filters, you can set up and generate SuiteAnalytics reports for sales tax data. There are many different reports included with this feature, such as Sales Tax Liability by Tax Item and Sales Tax on Sales Summary.

In order to access these reports, certain features and SuiteApps need to be installed:

- Required Features – To enable features in NetSuite, go to Setup > Company > Enable Features.

- On Company, enable multi-language

- On Tax, under Tax & Compliance, enable SuiteTax.

- On Analytics, go to SuiteAnalytics Workbook, click enable.

- On SuiteCloud, go to SuiteScript, click Serve SuiteScript.

- Required SuiteApps – after enabling the above features, these SuiteApps need to be installed:

-

- SuiteTax Engine

-

- Localization Assistant

From this point, you can install the U.S. Sales Tax Reports SuiteApp from the Marketplace in NetSuite.

Now that you have access to the filtering page, you can filter and export your reports into a SuiteAnalytics workbook:

- Go to Reports > Tax > US Tax Reports.

- Under Report – click the type of sales tax report you want.

- Under Subsidiary – select any subsidiaries you may have that you want filtered in.

- Under Date Range – select a start and end date.

- Under Accounting Book – if you use accounting books, select the ones you want.

- Click Generate Report.

NetSuite Sales Tax Reports:

Accounts without SuiteTax do not use SuiteApps, nor do they require certain features to be enabled before reports can be pulled. All the reports used for sales tax within the United States can be found under Reports > Sales Tax US > Sales Tax on Sales. The reports from this page can be filtered by date ranges and nexuses, and are either grouped by tax code, tax agency or transaction type depending upon the report. Reports can also be exported into either Excel, PDF, CSV, or Word, but each have their own advantages and limitations that should be reviewed for optimization.

- To Export a Report:

-

- On the Reports page, click the name of the report you want.

- In the report footer, click the icon of the export file format you need.

Outsource Your Tax Preparation to Us

You didn’t launch your business to file taxes. Or to learn about the tax laws in your country, to rationalize the right invoices, to keep organized records for years and years. No, that part of your business is actually an undesirable by-product. That’s why we created Sales Tax solutions.

Hand over all your concerns about tax compliance, and tax filing issues. And in return, you’ll get: Way more time to focus on growing your business and making your customers happy

Really, there’s no reason for you to stress over online retailer’s sales tax when they can be synchronized by a friendly, compatible team of tax consultants.

Let Sales Tax Solutions take care of the tough stuff!

Be aware of the filing deadline

All you need to do is tell us where your Shopify business is based. From this, and the sales tax information in your orders, Sales Tax solutions can give you specific filing deadlines.

Synchronizing your sales and order history

Once you link your Shopify store, we’ll pull in all of your order and sales history from the beginning of the year until today. Additionally, we also identify and break out sales tax info.

Prepare Tax Returns in Minutes

Through our synchronized efforts, we tabulate online store sales tax from every jurisdiction, whether it’s state, city, country, regional – we got you covered. We even provide summary information in a report that matches the forms on the state web site. We make Filing and remitting sales tax for your Shopify literally a breeze.

Additional Platforms

Contact Us

Use the form below to quickly send us an inquiry.

OUR news

Latest from our Blog

Get caught up on tax law changes, IRS updates, return deadlines, and so much more.

Make Way for Autopay: A Look at our Billing Changes

In the last six months, we have made several billing changes aimed at simplifying and improving sales tax management...

Streamlining Sales Tax Services on the Client Portal

Let's face it: sales tax is confusing, and no one likes to pay it, file it, or be responsible for it. At...

Managing Business Changes in the SalesTaxSolutions.US Client Portal

If you know anything about sales tax, you know that it's constantly changing. At SalesTaxSolutions.US, we are also...