Do you need to collect and remit sales tax in Florida?

f you meet the economic or physical nexus threshold in Florida, you must register with the Florida Department of Revenue to collect, report and remit Florida State sales tax and use tax to the state. There are two ways to register:

- Online through Florida Business Tax Application

- Completing and mailing a paper Florida Business Tax Application (Form DR-1)

There are a few situations that may exempt you from needing to register and file sales tax in Florida, such as providing non-taxable services or selling through a Marketplace Facilitator. However, in most situations where tangible goods are sold, sales tax must be charged and remitted to the state.

Do you have sales tax nexus in Florida?

There are two types of nexuses: physical and economic. If you have physical nexus, then you have some form of physical location from which you do business in Florida, such as a storefront. If you have economic nexus for Florida State sales tax, you will have met or surpassed the threshold of sales to other businesses or individuals in Florida.

Physical sales tax nexus in Florida

Common indicators of having physical nexus in Florida are:

- Having rentals, leases, or licenses to use property in Florida (such as offices or warehouses).

- Having short-term rentals, (such as hotels rooms, condominiums, and vacation houses).

- Renting or leasing personal property, (such as vehicles, machinery, and equipment).

Economic sales tax nexus in Florida

To have economic nexus in Florida, your business or company sales must exceed over $100,000 in the previous calendar year. Most businesses who qualify for economic nexus are out of state and sell product into Florida. Some products are exempt from Florida State sales tax, such as bottled water and vitamins and minerals. Here is a more detailed list of items that are nontaxable in Florida, related to Florida sales tax filing.

Are marketplace facilitators required to collect and remit sales tax in Florida?

As of July 1, 2021, marketplace facilitators must register to collect and electronically remit sales and use tax for taxable sales to Florida. In other words, if you sell through a marketplace facilitator, they are responsible for collecting and remitting sales and use tax on your product. However, if you sell or have intention of selling through a marketplace facilitator, make sure they are registered through the Florida Department of Revenue first.

What platforms are marketplace facilitators?

Some platforms that are considered marketplace facilitators are:

Not sure what a marketplace facilitator is? In short, marketplace facilitators are companies that provide a platform or service for third-party sellers (you) to sell their products or services to customers. The facilitator collects payment from the customer, processes the transaction, and may also manage shipping and returns.

Filing Florida State Sales Tax

Before you can begin your Florida sales tax filing, you must first register with the Florida Department of Revenue. You can either register using their online registration system or submit a paper Florida Business Tax Application.

Once your registration is processed, you will be sent a Certificate of Registration, a Florida Annual Resale Certificate for Sales Tax, and tax return forms (should you wish to submit paper forms).

After registering, you can file your Florida sales tax returns one of three ways:

File Online

- In our electronic age, filing Florida State sales tax returns is preferrable for many businesses. It is free with registration, faster and more user friendly for most people. To file electronically, enroll with Florida’s e-services. After enrolling, additional information about electronic filing will be sent to you.

- Note: If your business paid $5,000 or more in sales and use tax during Florida’s prior fiscal year (July 1-June 30), you must file electronically starting January the next calendar year.

Submit Paper Form

- You can fill out and mail form DR-15 for Florida State sales tax, postmarked by the 20th of the filing month, with a check or money order payable to the Florida Department of Revenue enclosed. Make sure that you write your certificate number on the check or money order, and that you have business information written or printed on the envelope. More instructions on how to file for DR-15 can be found here.

Let us handle your Florida sales tax filing for you!

Taxes are overwhelming. Add filing sales tax returns on top of running a business, and it can be nearly impossible to keep up. We at SalesTaxSolutions are here to make things easier! As a company, we help businesses like yours deal with the many state-by-state regulations and file your sales tax returns for you. We’ve got 20 plus years of knowledge and experience to help you get back to saving time and making money as soon as possible. Message, email or call us at 888-544-7730 for a free quote today!

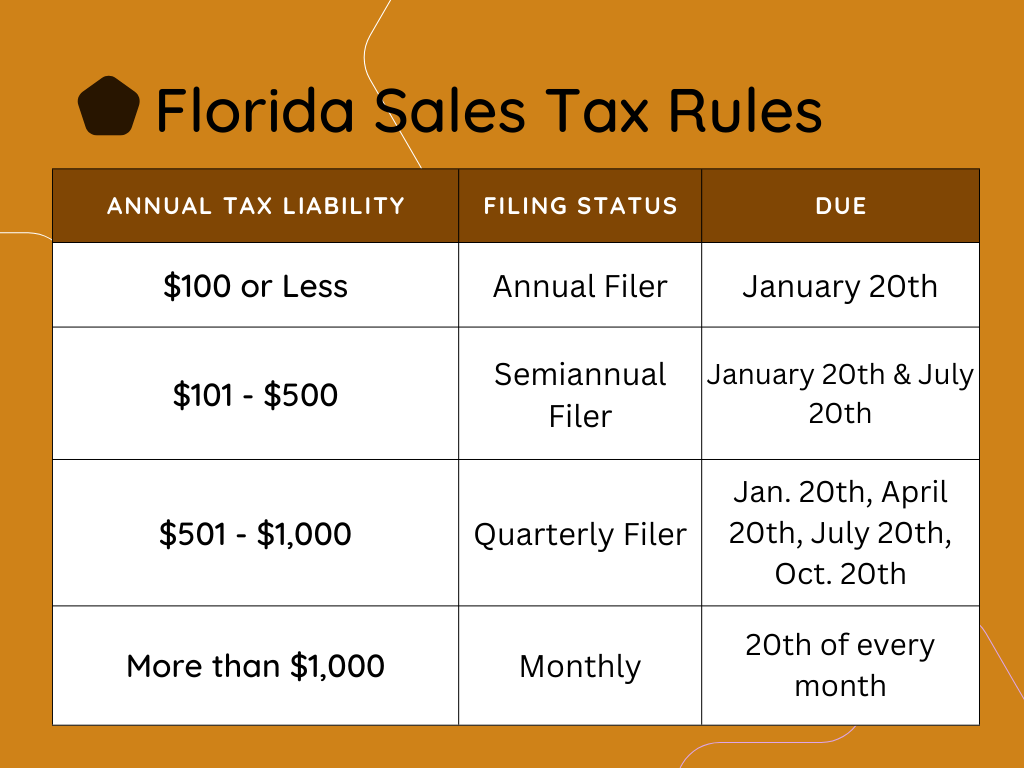

When are sales tax returns due in Florida?

Most new businesses who register to pay Florida State sales tax are set up for a quarterly filing frequency. How much sales tax you collect annually will determine whether that frequency is subject to change. See the infographic below: