Do you need to collect and remit sales tax in Georgia?

Georgia law requires all businesses with a physical presence in the state, including retail stores and some service providers, to collect sales tax on their taxable sales. But what about remote sellers? Out-of-state businesses that make sales to Georgia residents or companies but do not have a physical presence in the state may also need to collect and remit sales tax in Georgia under certain conditions. The determining factor of whether any business is liable for sales and use tax is whether that business has nexus in a state.

Note: Most services in Georgia are exempt from tax, such as tattoos, piercings, salon services, and itemized charges for repair labor or installation labor. A full list of nontaxable items and services can be found here.

Do you have sales tax nexus in Georgia?

So, what is nexus? Nexus refers to the connection or presence a business has in a state that requires it to collect and remit use and sales tax in Georgia. Sales tax nexus has two types: physical and economic. Physical nexus is established when a business has a physical presence in a state, such as a retail store or office. Economic nexus applies to economic activity, particularly a sales or transaction threshold into a state.

Physical sales tax nexus in Georgia

Physical nexus can be as simple as: you open a business in Georgia, you have nexus there. However, some businesses or activities that physical nexus applies to may come as a surprise. Examples of these are:

- Selling items at craft shows, fairs, seminars, conventions, etc.

- Any business that has employees or sales representatives in Georgia

- Storing inventory in a warehouse

- Storing inventory in a fulfillment center

Economic sales tax nexus in Georgia

If your business is located outside of Georgia or completely online, economic nexus is triggered when:

- Your annual gross revenue of Georgia sales exceeds $100,000 or;

- Your business exceeds an annual 200 separate in-state transactions.

Navigating the complexities of sales tax nexus can be overwhelming, including Georgia sales and use tax filing, especially if your business operates across multiple states. If you’re feeling the pressure, we offer al-a-carte Nexus Reviews as a hassle-free way to stay up to date with changing nexus regulations, ensuring compliance and giving you peace of mind.

Are marketplace facilitators required to collect and remit sales tax in Georgia?

Like other remote sellers, Georgia considers marketplace facilitators “dealers”, and are therefore required to collect and remit sales tax on facilitated retail sales. For remote sellers or businesses that sell product through a facilitator, they are not responsible for the taxes made on those sales; the marketplace is required to take care of that for them.

What platforms are marketplace facilitators?

Not sure what a marketplace facilitator is? In short, marketplace facilitators are companies that provide a platform or service for third-party sellers (you) to sell their products or services to customers. The facilitator collects payment from the customer, processes the transaction, and may also manage shipping and returns.

Filing Sales Tax in Georgia

Before you may file your Georgia sales tax returns, you must first register for a tax account number through Georgia Tax Center (GTC). This registration can only be done online. However, if you need to register in more than one state, Georgia is a certified member of Streamlined Sales Tax, which is an online tax system that allows businesses to submit a single application to register with any or all of their 24 member states. Regardless of which method you choose, you should receive a tax account number from Georgia via email.

After you have your tax account number Georgia sales and use tax filing, you can file one of three ways:

- Online – They strongly encourages businesses to visit the Georgia Tax Center and file their use and sales tax in Georgia electronically. If a taxpayer owes more than $500.00 in their filing period, they are required to file and pay online. It is also important to note that if a taxpayer remits payment by electronic funds transfer at any time, all the returns associated with that payment must also be filed online.

- Paper Form – For taxpayers that are not required to file electronically, Form ST-3 can be filled out and postmarked by the due date of the return. Make sure that you are using the correct form for the period in which you are filing, as Form ST-3 is often updated.

- Let us file for you – If filing sales tax returns including sales tax in Georgia, is too overwhelming or time-consuming, you’re not alone. Running a business is demanding work and filing tax returns is a nuisance. We at SalesTaxSolutions are here to make things easier! As a company, we help businesses like yours deal with the many state-by-state regulations, including Georgia sales and use tax filing, and file your sales tax returns for you. We’ve got 20 plus years of knowledge and experience to help you get back to saving time and making money as soon as possible. Message, email or call us at 888-544-7730 for a free quote today!

When are sales tax returns due in Georgia?

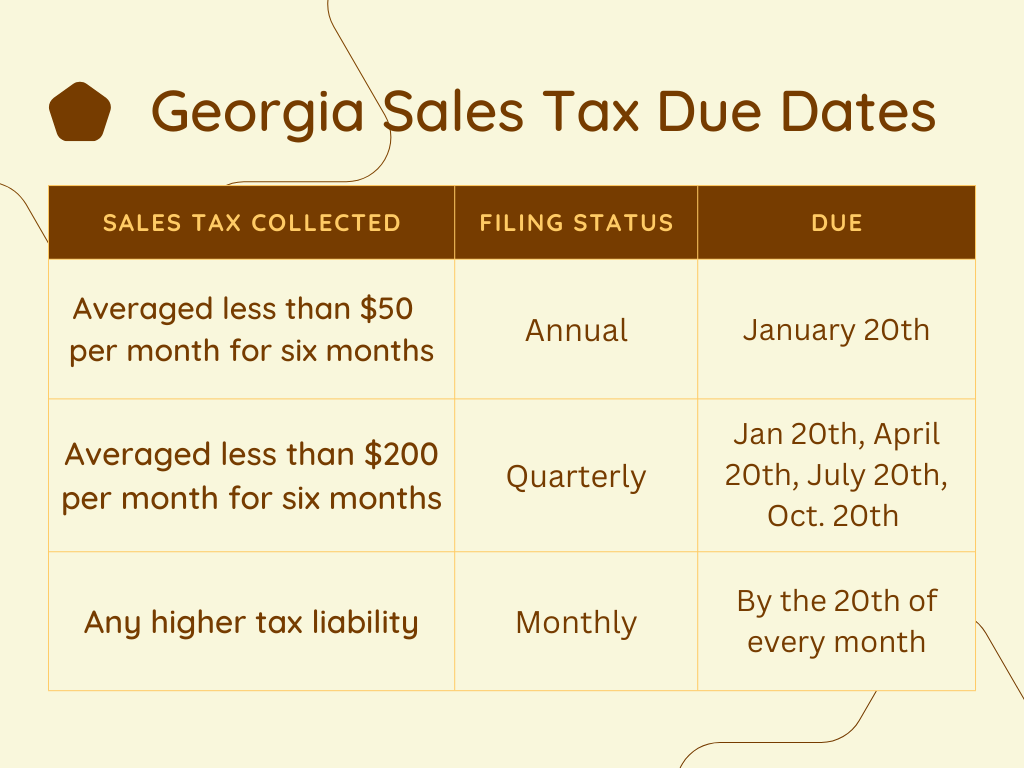

For the first six months following registration, businesses will be required to file their sales tax returns monthly, including those for sales tax in Georgia. After these six months are up, a request for a filing frequency change may be made dependent upon tax liability. See the graphic below for a breakdown of these frequencies and their due dates.