Do you need to collect and remit sales tax in Hawaii?

Every person, business, corporation or otherwise doing business in Hawaii must collect and remit General Excise Tax (GET) on their gross business income in addition to Hawaii sales tax filing. What is the difference between GET and sales tax? Sales tax is a tax on customers, while GET is a tax on businesses. Some businesses choose to charge their customers GET like they would a sales tax, but unlike sales tax, charging GET is not required by law. Most businesses are also subject to other forms of Hawaii taxation, such as use, income, and withholding taxes.

Out-of-state businesses that are considered to have enough presence in Hawaii are also subject to sales tax in Hawaii. This sufficient presence is defined as having nexus in the state, which we cover in greater detail below.

Do you have sales tax nexus in Hawaii?

Nexus has two forms: physical and economic. Physical nexus is established when a business has a tangible presence in the state, such as having a brick-and-mortar store, employees, or inventory. Economic nexus focuses on a business’ financial activities within a state, rather than its physical presence. If a business exceeds a certain threshold of sales or transactions in Hawaii, economic nexus is established, and that business must collect and remit sales tax in Hawaii. Both physical and economic nexus can impact a business’ general excise tax obligations, registration requirements, and compliance measures.

Physical sales tax nexus in Hawaii

Some examples of physical nexus in Hawaii include:

- Having an office

- Storing inventory

- Owning business property

- Having employees in the state

- Offering services in conjunction with sales of property, such as training, installation, or repairs

Economic sales tax nexus in Hawaii

Economic nexus in established when a business has annual gross receipts of $100,000 or more to Hawaiian customers or has 200 or more transactions with Hawaiian customers, leading to Hawaii sales tax filing obligations. Because there can often be complexities in determining what qualifies as a transaction, out-of-state businesses are encouraged to contact the Hawaii Department of Taxation. Alternatively, (shameless plug-in here), we at SalesTaxSolutions.US offer Nexus Reviews in all states, either al-a-carte or as part of a month-to-month subscription service with a ton of bonuses!

Are marketplace facilitators required to collect and remit sales tax in Hawaii?

TIR 19-03 Rev 2, enacted on January 1, 2020, clarifies that in Hawaii, marketplace facilitators are responsible for collecting and remitting excise tax on behalf of their sellers. This means that if you sell products or services through an online marketplace, the platform itself handles the excise tax.

What platforms are marketplace facilitators?

Not sure what a marketplace facilitator is? In short, marketplace facilitators are companies that provide a platform or service for third-party sellers (you) to sell their products or services to customers. The facilitator collects payment from the customer, processes the transaction, and may also manage shipping and returns.

Filing Sales Tax in Hawaii

So you need to file Hawaii excise tax returns and don’t know where to get started? These step-by-step instructions should help:

| Step | Information |

| 1 | Register for a Hawaii Tax Identification Number (HI Tax ID) and a General Excise Tax (GET) license, and complete your Hawaii sales tax filing. You can register online through the Hawaii Department of Taxation (DOTAX). If you have employees, you will also need an Employer’s Withholding License, which withholds Hawaii income taxes from your employee’s wages. |

| 2 | Consider whether you need any additional tax licenses including those for sales tax in Hawaii. Depending on your business activities, you may need licenses for transient accommodations, rental motor vehicles, tour vehicles, car-sharing vehicles, cigarettes and tobacco, liquor, and fuel. You can find more information on which licenses you need on Form BB-1, State of Hawaii Basic Business Application. |

| 3 | Figure out which GET rate applies to your business. Most businesses are subject to a 4% GET rate, but some industries have different rates. For example, the rate for wholesale sellers is 0.5%. |

| 4 | File you GET returns and pay the tax due, including Hawaii sales tax filing. You can file and pay your GET returns online through DOTAX or using Form G-45 for monthly, quarterly and semianual filers, and Form G-49 for annual returns and reconciliations. Note that taxpayers whose annual liability exceeds $4,000 are required to file online. |

Let us file for you!

Simplify your sales tax filing process, including sales tax in Hawaii with the expertise of SalesTaxSolutions.US, the go-to solution for Hawaii excise tax and other state sales tax obligations. Our team of seasoned professionals offers an array of essential services, including filing and remitting Hawaii excise tax and other state sales taxes, along with audit representation and tax compliance consulting. Stay ahead of ever-changing tax laws and regulations with our reliable support!

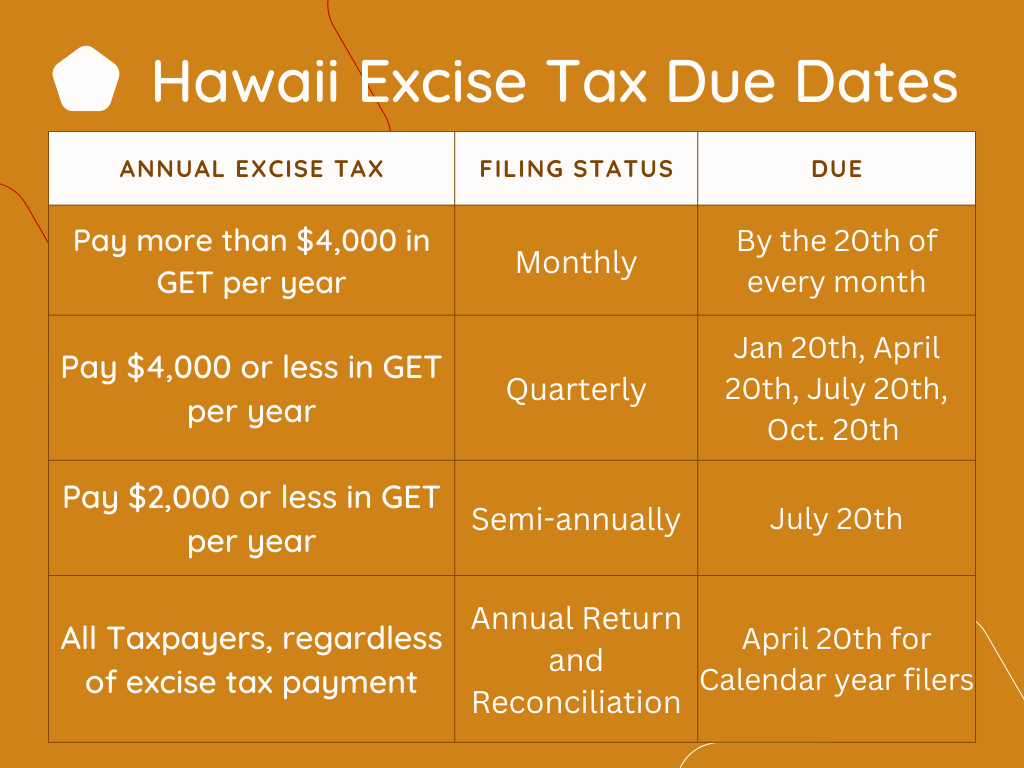

When are sales tax returns due in Hawaii?

The frequency with which you must file your Hawaii excise tax returns, including Hawaii sales tax filing depends upon the amount of GET your business has to pay during the year. We’ve provided the graphic below to break down these filing frequencies and their due dates.