Do you need to collect and remit sales tax in Iowa?

If you are a retailer or seller in Iowa or a remote business that exceeds a certain number of sales into Iowa, then you must collect and remit sales tax. Sales tax applies to sales of tangible personal property, specific digital products, and taxable services. There are some items that may be exempt from Iowa sales tax, including:

- Rental of conference rooms and banquet rooms in Iowa.

- Certain contractor services (such as brick laying, concrete finishing, tiling, and carpet installation).

- Food stamp purchases.

- Most medical devices and prescription drugs.

- Sales to nonprofit organizations.

You can find a more detailed list of what is and is not taxable in Iowa here.

Do you have sales tax nexus in Iowa?

Nexus is the physical or economic presence in a state that makes a business liable for sales tax in Iowa. Physical nexus is determined when a business has a base of operations or employees in a state. Economic nexus is dependent upon whether an out-of-state retailer meets or exceeds a set number of gross sales or transactions into a state. Taxpayers that have nexus and require States of Iowa sales tax filing must register with Iowa to collect and remit sales tax on transactions made to customers or entities in the state. We break down more examples of physical and economic nexus in Iowa below.

Physical sales tax nexus in Iowa

A business with physical nexus in Iowa is any retailer that has:

- A permanent or temporary place of business

- Employees or other representatives in the state

- Property located in Iowa

Economic sales tax nexus in Iowa

Economic nexus, pertaining to sales tax in Iowa, only applies to remote retailers that have made $100,000 or more in gross revenue from Iowa sales in the current or previous year. Note that, unlike some states, Iowa only considers taxable sales in the $100,000 economic threshold, so it is important to know whether the items or services you sell are taxable.

As you can see, determining nexus for your business can sometimes be a complex and daunting task. With many factors to consider, many businesses struggle to navigate the intricacies of nexus determination, and even end up paying thousands of dollars to accounting firms to get answers. That’s why we offer nexus determination, including States of Iowa sales tax filing as an a-la-carte or package deal for businesses at affordable prices. With over 20 years of experience in federal and state tax and accounting laws, we’re a trusted partner for many businesses in need of nexus review services. Contact us now for a consultation!

Are marketplace facilitators required to collect and remit sales tax in Iowa?

Yes, but only if that marketplace facilitator has nexus in Iowa. Marketplace facilitators that exceed $100,000 of Iowa taxable sales in the current or previous year must register with the Iowa Department of Revenue and collect sales tax on behalf of the sellers that use their platform. For example, if a business only makes sales in Iowa through a marketplace facilitator and knows that that facilitator is collecting sales tax on their Iowa sales, then the business will not need to obtain an Iowa sales tax permit or file returns.

What platforms are marketplace facilitators?

Not sure what defines a marketplace facilitator? In short, marketplace facilitators are companies that provide a platform or service for third-party sellers (you) to sell their products or services to customers, often handling sales tax in Iowa. The facilitator collects payment from the customer, processes the transaction, and may also manage shipping and returns.

States of Iowa Sales Tax Filing

Filing sales tax can often feel like an impossible task, so here’s a step-by-step breakdown to get you started!

| Step | Description | Additional Information | Forms & Resources |

| 1 | Figure out if sales tax applies to your business. | Iowa sales tax is imposed on the sales price of tangible personal property, specified digital products, or taxable services at the time the sale takes place. | Iowa Sales and Use Tax Guide |

| 2 | Register for a sales and use tax permit | Retailers can either register for a permit online, via paper form, or by using Streamlined Sales Tax, which is a free registration system for businesses that need to register in any or all of the 24 Streamlined member states. | Streamlined Sales Tax; Online registration at GovConnectIowa; IA Business Tax Registration Form 78005 |

| 3 | Collect sales tax from customers | The seller handles collecting, reporting and remitting sales tax in Iowa. | Iowa Sales and Use Tax Guide |

| 4 | File sales and use tax returns | Sales and use tax returns must be filed electronically through GovConnectIowa. | Iowa Sales Tax Efile |

| 5 | Pay sales and use tax | Sales and use tax must be paid by your filing frequency due date to avoid penalties and interest. | Filing Frequencies and Due Dates |

When are sales tax returns due in Iowa?

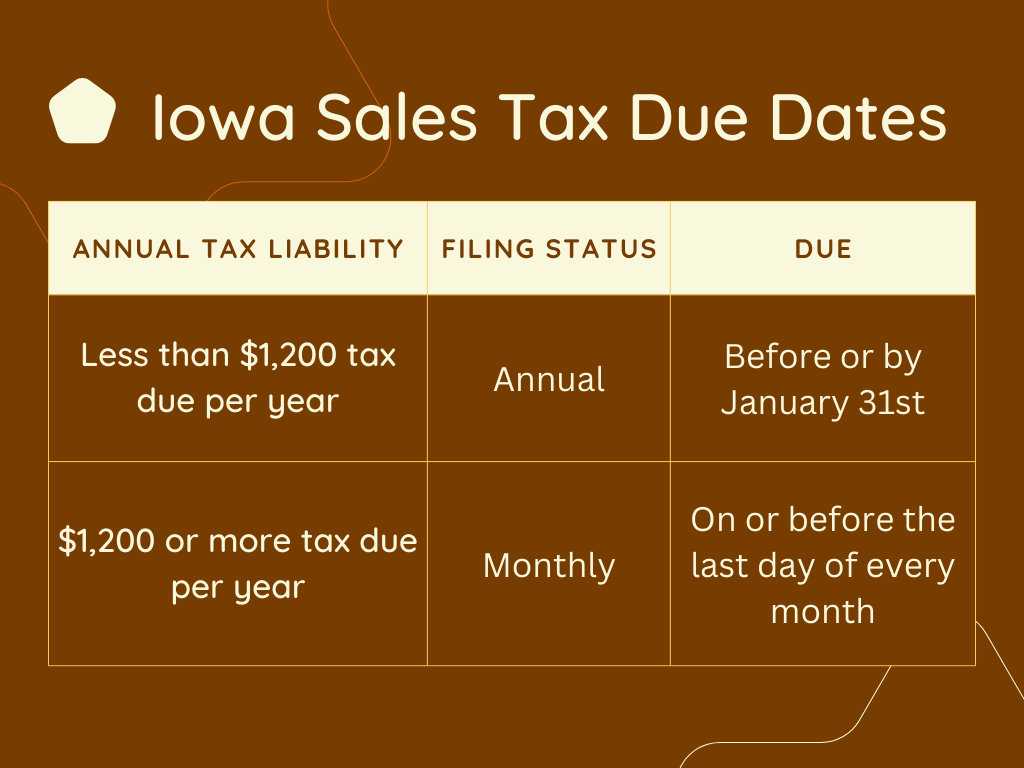

Iowa only has two sales tax filing frequencies: annual and monthly. The filing frequency assigned to a taxpayer depends upon the amount of Iowa tax liability a business has per year. See the graphic below for a breakdown of the tax liability and the associated filing frequencies.

It is important to note that retailers, especially those dealing with sales tax in Iowa, can request a filing frequency change by logging into their GovConnectIowa account and submitting a Filing Frequency Change Request, or by filling out and submitting the Iowa Business Tax Change Form (92-033). Filing frequencies are also subject to change by the Iowa Department of Revenue upon review.