Do you need to collect and remit sales tax in Mississippi?

If your business sells tangible personal property or taxable services, then typically, the answer is yes. What is tangible personal property? Simply, it is property that can be seen, touched, or is in any manner perceptible to the senses. However, this definition excludes real property, such as land and real estate.

In the case of services, not everything in taxable. Some services that are taxable include:

- Repairs of tangible personal property

- Pest control

- Plumbing

- Electrical work

- Contracting, (there is a separate contractor tax in Mississippi at a rate of 3.5% if the contract price or compensation exceeds $10,000).

There are other exemptions to having to collect and remit sales tax. For example, if you are an online retailer, you will only have sales tax responsibility if your gross sales to Mississippi customers exceed a set threshold, (more on this later). Additionally, some items are automatically exempt from Mississippi sales tax. Here are a few:

- Prescription drugs

- Gasoline

- Feed for livestock and poultry

- Sales made to the federal government, non-profit organizations, and schools

Do you have sales tax nexus in Mississippi?

Nexus is an important term to understand in the world of sales tax. Sales tax nexus is a connection a company has with a state that requires it to collect and remit sales tax. There are two different distinctions of nexus: physical and economic.

Physical sales tax nexus in Mississippi

Physical sales tax nexus is all about physical presence, such as having an office or retail store, as well as having sales representatives who solicit orders on behalf of a business.

Economic sales tax nexus in Mississippi

In Mississippi, economic nexus is based on the amount of economic activity that occurs in a state. In other words, if you exceed a threshold of sales, then you must collect sales tax.

For an out-of-state seller to have economic nexus with Mississippi:

- The business’s gross sales or income to Mississippi customers must exceed $250,000 over a twelve-month period.

Determining nexus for your business can be a complex and daunting task. With many factors to consider, businesses struggle to navigate the intricacies of nexus determination, and even end up paying thousands of dollars to accounting firms to get answers. That’s why we offer nexus determination as an a-la-carte or package deal for businesses at affordable prices. With over 20 years of experience in federal and state tax and accounting laws, we’re a trusted partner for many businesses in need of nexus review services. Contact us now for a consultation!

Are marketplace facilitators required to collect and remit sales tax in Mississippi?

In Mississippi, marketplace facilitators are mandated to collect and remit sales tax for third-party sellers if they exceed the economic nexus threshold. What is a marketplace facilitator? Simply, marketplace facilitators are entities or platforms that enter into agreements with third-party sellers to help them sell their goods or services, either through a physical store or an online platform. If that facilitator’s Mississippi sales exceed $250,000 in 12 consecutive months, they take on the responsibility of collecting and remitting taxes based on sales made through their marketplace. If you are using a marketplace facilitator, it is important to receive documentation that the facilitator is registered with Mississippi and complying with sales tax collection and remittance.

What platforms are marketplace facilitators?

Filing Mississippi Sales Tax

If you’ve determined that you need to start collecting and remitting sales tax in Mississippi, your first step is to register for a Mississippi Sales and Use Tax Account. These registrations are done completely online through Mississippi’s Taxpayer Access Point (TAP). After following the registration steps, a packet with your sales tax permit and other filing information will be mailed to you within two weeks.

How to file MS sales tax

Mississippi sales tax returns can be filed one of two ways:

- Paper Filing

- Pre-addressed sales tax returns are mailed 30 days before the due date and need to be postmarked and paid by the due date.

- Online Filing

- If you hate paperwork and want a faster option, you can file your sales tax returns online through TAP.

To encourage taxpayers to file before or by the due date, Mississippi offers a 2% Vendor’s Discount. This discount is based on tax liability and is limited to $50.00 per reporting period.

Overwhelmed and struggling to navigate the complex world of sales tax compliance? You’re not alone. Many businesses find themselves in that very situation, which is where SalesTaxSolutions.US comes in. As a trusted provider of comprehensive sales tax consulting services for businesses of all sizes and industries, our team of experts is dedicated to helping you streamline your sales tax processes and stay compliant with changing regulations. We handle the entire process for you, from nexus reviews to registration to filing. Reach out to us today!

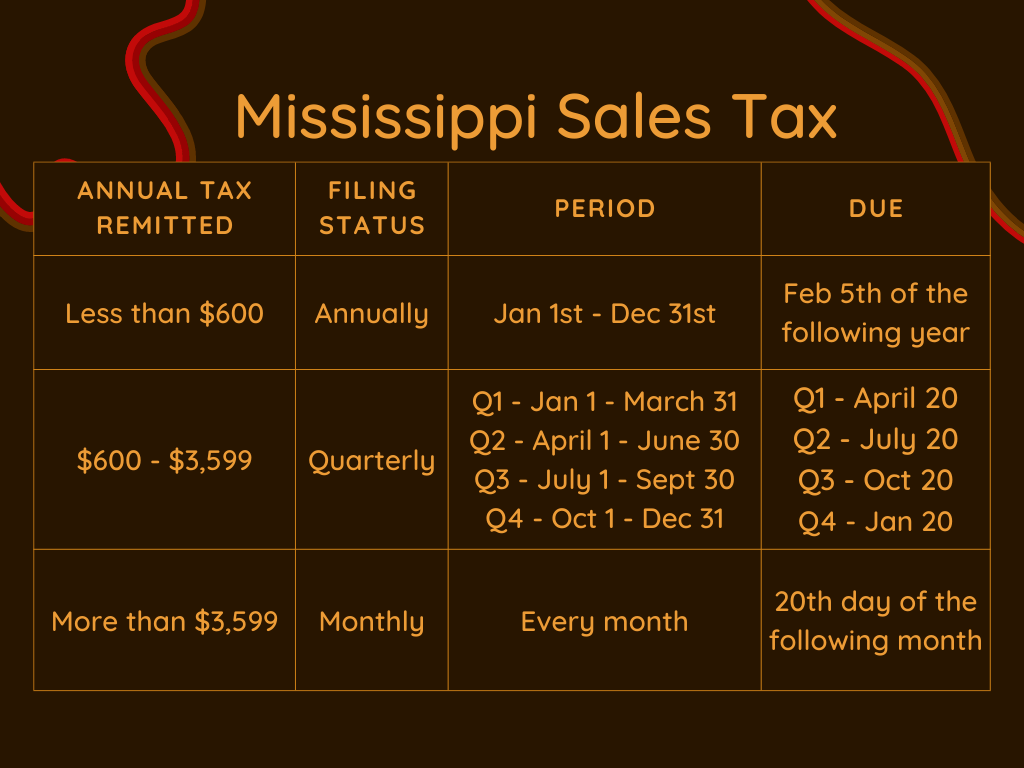

When are sales tax returns due in Mississippi?

Mississippi assigns each taxpayer a filing frequency after registration. There are three types of filing frequencies: monthly, quarterly, and annually, assigned based on annual tax liability. The more tax you collect and remit per year, the more often you will need to file. Regardless of your filing frequency, all sales tax returns are due on the 20th of the month following a reporting period. Take a look at our graphic below for a breakdown of these filing frequencies.