Do you need to collect and remit sales tax in Missouri?

Sales tax is a crucial part of doing business. In Missouri, if you run a business engaged in retail sales, leasing tangible personal property, or certain services, you are required to collect and remit sales tax. Examples of taxable sales and services in Missouri include:

- Clothing

- Electronics

- Home appliances

- Utilities for commercial use

- Telecommunications services

- Hotel services

Additionally, if you are an out-of-state retailer that sells products or services into Missouri, you may need to collect and remit Vendor’s Use Tax if your sales exceed a certain threshold. Remote sellers exclusively collect and pay vendor’s use tax, whereas businesses that make sales from a Missouri location are responsible for sales tax.

However, not everything in Missouri is subject to tax. Here are a few common exemptions to consider:

- Utilities for domestic use

- Farm machinery for agricultural purposes

- Livestock sales

- Medical devices

- Prescriptions

- Janitorial Services

- Repair labor

Do you have sales tax nexus in Missouri?

What is sales tax nexus, and how do you know if you have it? Sales tax nexus refers to the connection between a business and a state that requires the business to collect and remit sales tax. In Missouri, there are two main types of nexuses: physical and economic.

Physical sales tax nexus in Missouri

Physical nexus is all about physical presence and applies when a business has a brick-and-mortar location, employees, or inventory in Missouri.

Businesses with physical nexus in Missouri will collect and remit sales tax.

Economic sales tax nexus in Missouri

Economic nexus, the counterpart of physical nexus, is all about economic activity. Because businesses with physical nexus are automatically responsible for collecting and remitting sales tax regardless of taxable income, it may put them at an unfair disadvantage when in comparison to remote or online retailers. Additionally, with the rise of ecommerce, sales tax revenue has the potential to dwindle. For these reasons, economic nexus is used. If a business exceeds a set threshold of taxable sales into Missouri, they are considered to have enough presence in the state to be taxable. That sales threshold is:

- Taxable sales that exceed $100,000 in a year.

Remote sellers with economic nexus in Missouri will collect and remit vendor’s use tax, which is just a sales tax designation used for out-of-state businesses.

Determining nexus for your business can be a complex and daunting task. With many factors to consider, businesses struggle to navigate the intricacies of nexus determination, and even end up paying thousands of dollars to accounting firms to get answers. That’s why we offer nexus determination as an a-la-carte or package deal for businesses at affordable prices. With over 20 years of experience in federal and state tax and accounting laws, we’re a trusted partner for many businesses in need of nexus review services. Contact us now for a consultation!

Are marketplace facilitators required to collect and remit sales tax in Missouri?

Marketplace facilitators play a critical role in the world of ecommerce and sales tax. What is a marketplace facilitator? At its baseline, a marketplace facilitator is defined as any entity that facilitates the sale of tangible personal property or certain services on behalf of sellers through a physical or electronic marketplace.

Like remote sellers, marketplace facilitators are responsible for collecting and remitting vendor’s use tax if their total taxable Missouri sales exceed $100,000 in a year. But because marketplace facilitators are platforms used by multiple retailers, the responsibility of tax collection and remittance transfers from the seller to the marketplace. In other words, if you sell through a marketplace facilitator with economic nexus in Missouri, you are not responsible for taxes made on those sales.

What platforms are marketplace facilitators?

Filing Missouri Sales Tax

Before you can file your Missouri sales or vendor’s use tax returns, there are a few steps you need to take. The following table provides a step-by-step guide to help you through this process:

| Step | Description | Instructions | Resources |

| 1 | Determine if your business needs to collect and remit Missouri sales or vendor’s use tax | Review your business activities and sales to determine if you are engaged in taxable transactions in Missouri. Additionally, you can contact us for a nexus review. | Missouri Department of Revenue – Sales Tax |

| 2 | Register for a Missouri sales tax license | Complete the online registration process through the Missouri Department of Revenue’s website or fill out their paper registration form. | Online Business Registration; Paper Forms |

| 3 | Wait for your license | Your tax number will be issued within 10 business days from the date the department receives your application. Do not collect sales or use tax before you receive your tax license. | |

| 4 | Collect Missouri sales or vendor’s use tax | Apply the appropriate sale tax rate to taxable transactions and collect the tax from customers at the time of sale. Remember that Missouri also has local taxes on top of the state sales tax rate. These local taxes will be based upon the location of your customer. | Missouri Sales Tax Rate Information |

| 5 | File Missouri sales or vendor’s use tax returns | You can submit your returns through the online filing system or using a paper form. Note that Missouri strongly encourages taxpayers to file electronically to avoid delays in processing and potential errors. To file electronically, you can either register with the MyTax Missouri Portal or file as a guest user. | MyTax Missouri Portal; Guest Filing; Paper Forms |

| 6 | Keep accurate records | Missouri sales and use tax laws indicate that records must be kept for at least three years in the case of an audit. |

We hope that you find this table useful, and if you need additional help, contact the Missouri Department of Revenue. Additionally, keep these tips in mind:

- Sales tax returns must be filed for each period in your filing frequency even if you have no sales or tax to report.

- All returns filed and paid by the required due date are granted a 2% timely filing allowance, subtracted based on the amount of tax due/0.02.

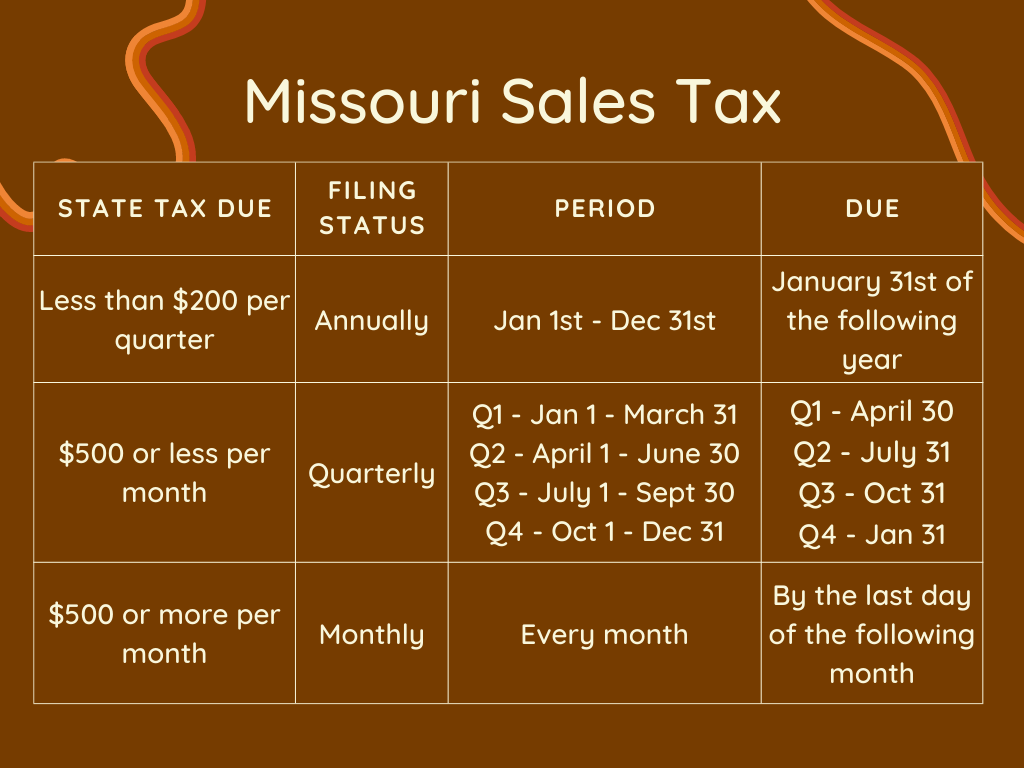

When are sales tax returns due in Missouri?

Each business is assigned a filing frequency in Missouri, determined by the amount of state tax (4%) due. Take a look at the graphic below for a breakdown of filing frequencies in Missouri, as well as their associated due dates.