Do you need to collect and remit sales tax in Pennsylvania?

Sales and use tax in Pennsylvania applies to various transactions involving tangible personal property, including digital products and some services. In most cases, retailers must collect and remit sales tax.

However, there are some important exemptions to keep in mind:

- Non-prepared foods, like groceries

- Candy

- Gum

- Most clothing

- Textbooks

- Computer services

- Prescription and OTC drugs

- Sales for resale (such as through a wholesaler)

In addition to the general sales tax, Pennsylvania also applies a hotel occupancy tax. This tax is charged to temporary room rentals—including rentals through platforms like Airbnb—at the same rate as sales tax.

For remote retailers who do not have a physical presence in Pennsylvania, (like a physical store), sales tax requirements are determined by gross annual sales to the state. If these sales exceed $100,000, then they need to register for a sales tax license and collect and remit.

Do you have sales tax nexus in Pennsylvania?

One of the most critical components of sales tax in the modern age is nexus. In Pennsylvania, there are two types of sales tax nexus businesses need to keep in mind: physical nexus and economic nexus.

Physical sales tax nexus in Pennsylvania

Physical sales tax nexus means having a physical presence in the state that would require a business to collect and remit sales tax. Examples of physical nexus include maintaining offices, distribution houses, warehouses, or employing agents who work in the state. Additionally, having goods stocked in the state or soliciting orders through salesmen or representatives could also qualify as physical sales tax nexus.

If a business has physical sales tax nexus in Pennsylvania, they will be required to collect and remit sales tax on taxable sales, regardless of sales volume.

Economic sales tax nexus in Pennsylvania

On the other hand, economic sales tax nexus is related to economic activity. This type of nexus applies to remote retailers who don’t have any physical presence in Pennsylvania but who still meet certain sales thresholds. This threshold is set to indicate that a business, regardless of location, has enough economic influence to be comparable to an in-state retailer.

Each state has its own sales threshold for economic nexus. In Pennsylvania, the threshold is meeting or exceeding $100,000 in annual gross sales to the state. Remote retailers need to calculate their sales every year, including all taxable and nontaxable sales, to determine if they meet this threshold. However, sales through a marketplace facilitator registered with Pennsylvania are not included in this calculation.

Are marketplace facilitators required to collect and remit sales tax in Pennsylvania?

Just like other remote retailers, marketplace facilitators must meet the economic threshold of $100,000 in annual gross sales to Pennsylvania to be held liable for sales tax collection and remittance. This calculation combines all Pennsylvania sales across all sellers. If a facilitator does meet this threshold, they will be required to register with the Pennsylvania Department of Revenue to handle sales tax on behalf of the sellers using their platforms.

If you sell through a marketplace facilitator, the good news is that you don’t have sales tax responsibility for those sales. However, it’s important to ensure that the marketplace facilitator you’re using is registered with the state to collect sales tax on your behalf.

What platforms are marketplace facilitators?

What is a marketplace facilitator?

A marketplace facilitator, sometimes referred to as a Multivendor Marketplace Platform (MMP), is an online platform that allows customers to purchase goods or services from various vendors in one convenient location. These platforms can benefit businesses by increasing product visibility and attracting a larger customer base. Additionally, marketplace facilitators often have the legal responsibility to collect and remit sales tax on behalf of sellers, which can help ease the sales tax burden for businesses.

Filing Pennsylvania Sales Tax

If your business has nexus in Pennsylvania, it is necessary to register for and obtain a sales tax license. Pennsylvania offers two methods for registering and obtaining a license, which are outlined in the table below.

| New Businesses | Add tax accounts to existing businesses |

| Access the myPATH homepage | Log in to myPATH |

| Select the Pennsylvania Online Business Tax Registration link from the Registration panel | Under the More tab, select Register New Business Tax Accounts from the Accounts panel |

| Select Business Tax Registration | Select Business Tax Registration |

| Provide the required information | Provide the required information |

| You should receive your registrations details and account number via email. This will also be sent in the mail. | You should receive your registrations details and account number via email. This will also be sent in the mail. |

As part of the registration process, Pennsylvania will assign you a filing frequency which will let you know how often you need to file. New businesses are initially assigned a quarterly filing frequency, which we will dive into more in the next section.

Once you’ve collected sales tax for a quarter, it’s time to file. We’ve detailed all the information and filing options available in the table below.

| Filing Option | Description |

| TeleFile | To TeleFile, call 1-800-748-8299. Provide your Sales Tax Account ID Number, your FEIN or SSN, or your Pennsylvania Revenue ID. Provide sales data, such as gross and taxable sales over the phone as well. (To be decommissioned after December 31,2023.) |

| Third-Party Software | File through approved software vendors such as Trustfile, Intuit Quickbooks, Vertex, TaxJar, and AviorData. |

| myPATH | Filing and paying online is strongly encouraged as it ensures less chance of error and delay. Log in to myPATH, select the Sales and Use Tax account panel, and select the File Now link for the current period. |

To submit payments for sales tax returns, you can use ACH Debit or a Credit Card via myPATH, submit payment through TeleFile, or mail a paper check.

Let us file for you!

If you’re looking for help with a myriad of sales tax obligations, that’s why we’re here! We are a one-stop-shop for comprehensive sales tax services! Our range of services includes nexus determination, business registration, compliance reviews, audit assistance, and—of course—filing sales and use tax returns. If you don’t see what you need, just let us know and we’ll create a customized solution just for you. Visit our services page to learn more!

When are sales tax returns due in Pennsylvania?

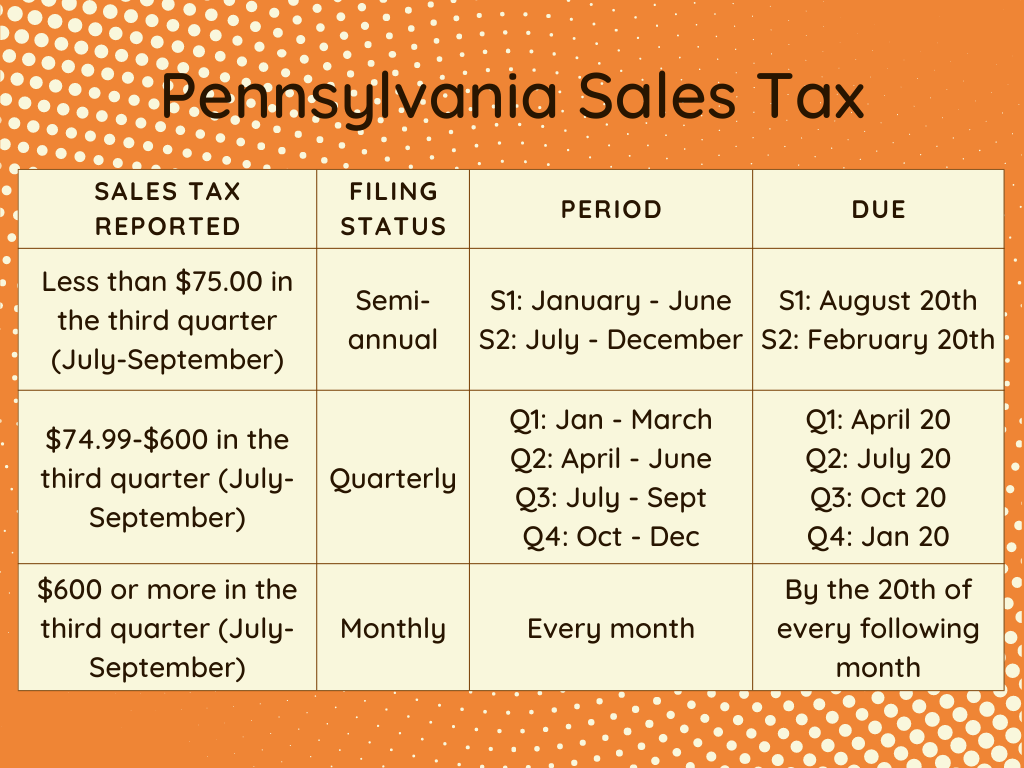

When you register your new business as a taxpayer with Pennsylvania, you will be assigned an initial quarterly filing frequency. If you’re wondering what periods this covers, the graphic below breaks down Pennsylvania’s different filing frequencies and their corresponding due dates.

It’s important to note that each November, Pennsylvania conducts a filing frequency assessment for all sales tax accounts. If your frequency needs to be changed based on the tax you reported in the previous third quarter (July-September), you will receive a notification and will need to adjust your filing accordingly. Stay proactive and keep an eye out for any updates from Pennsylvania regarding your filing frequency.