Do you need to collect and remit sales tax in Utah?

If you sell products and/or services in Utah or to customers in Utah and meet the economic or physical nexus threshold, you must collect and remit sales tax. Certain particulars may exempt you from needing to file, such as if you sell your product through a marketplace facilitator. There are also some services that are not taxable. Every business is different, so it is important to become familiar with each state’s tax laws to see how they pertain to you.

Do you have sales tax nexus in Utah?

There are two types of nexuses: physical and economic. Physical applies to having a physical location from which you do business in Utah, such as a storefront. Economic presence means that you have exceeded a certain number or sales or gross amount. Other indicators of a seller having nexus in Utah are:

- A seller has more than 10% interest in a related seller, or vice-versa.

- The seller sells the same or similar product as a related seller under the same or similar business name.

- A related seller’s place of business or an in-state employee is used to advertise, promote or assist sales by the seller.

Physical sales tax nexus in Utah

You qualify for physical nexus in Utah if you have one of the following:

- Have or use an office, distribution house, sales house, warehouse, service enterprise or other physical business location.

- Maintain a stock of goods or inventory in state.

- Regularly solicit orders in state.

- Regularly deliver property, (not by common carrier or U.S. mail).

- Regularly lease or service property in state.

Economic sales tax nexus in Utah

You qualify for economic nexus in Utah if, during the year or prior year, you:

- Have more than $100,000 of sales in Utah, or

- Have more than 200 sales in Utah.

Are marketplace facilitators required to collect and remit sales tax in Utah?

If you sell through a marketplace facilitator, the facilitator themselves are responsible for collecting, reporting and paying sales tax to Utah. That means you, as a seller on that marketplace, are not held liable for the taxes accrued from product sold through them.

What platforms are marketplace facilitators?

Some platforms that are considered marketplace facilitators are:

Not sure what a marketplace facilitator is? A marketplace facilitator, sometimes referred to as a Multivendor Marketplace Platform (MMP), is an online platform that allows customers to purchase goods or services from various vendors in one convenient location. These platforms can benefit businesses by increasing product visibility and attracting a larger customer base. Additionally, marketplace facilitators often have the legal responsibility to collect and remit sales tax on behalf of sellers, which can help ease the sales tax burden for businesses.

Filing Utah Sales Tax

Like most states, Utah recommends filing electronically to ensure prompt and accurate returns. Some taxes must be filed online, but most can be filed with paper returns if desired. To file electronically through Utah TAP (Taxpayer Access Point), you will have to register an account by either:

After registering either online or through the paper form, you will receive an Account Number and PIN (Personal Identification Number) from the state to create your login credentials. Note that even if you have no tax liability due for your filing period, you must still file by the due date. Detailed instructions on how to file your sales and use tax return online can be found here.

When are sales tax returns due in Utah?

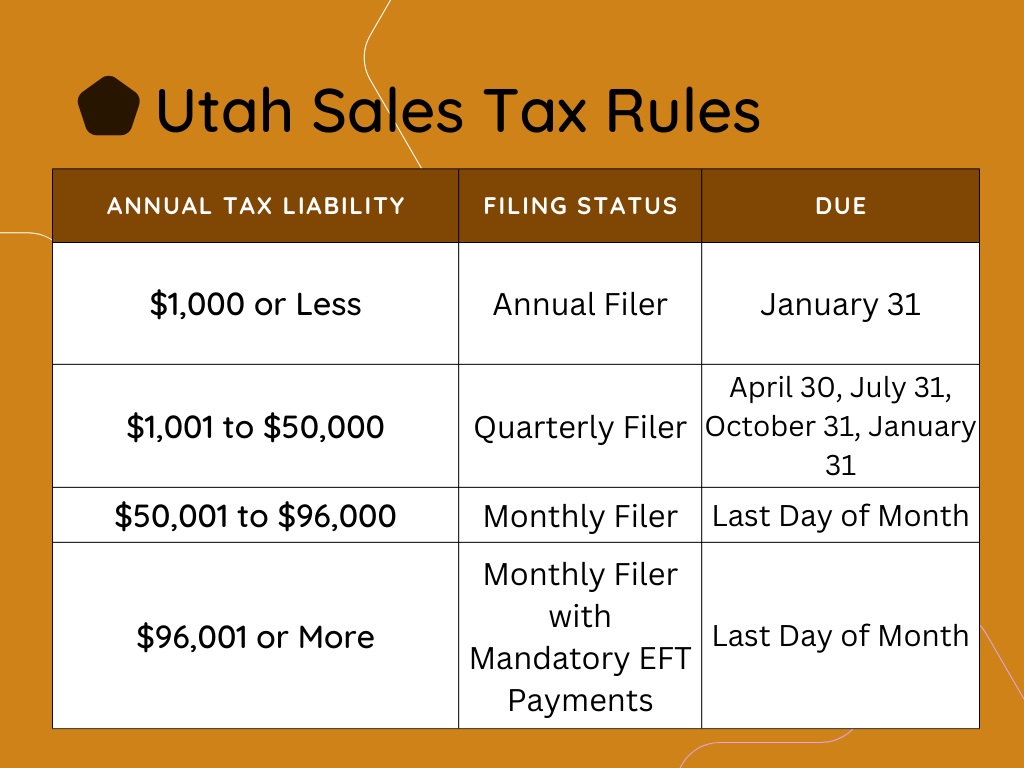

When you register with the state of Utah to file sales and use taxes, your filing frequency and due dates are determined depending upon your Annual Tax Liability. Utah will assign a filing frequency to you dependent upon your reported sales and will change your frequency if necessary. See chart below:

As you can see, all sales tax returns in Utah are due the last day of the month after the filing period. If a due date happens to fall on a holiday or a weekend, returns are due the next business day.