Do you need to collect and remit sales tax in Wyoming?

Whether or not your business needs to collect and remit sales tax in Wyoming depends on several things. If your business is categorized as a vendor operating in Wyoming, which includes selling retail products, granting admission, or providing taxable services, you must be registered and licensed with the state to collect and remit what Wyoming refers to as “excise tax.”

But being a vendor in Wyoming isn’t confined to those with physical premises within the state. It could also include those operating online businesses based in Wyoming or even remote retailers whose sales or transactions into the state exceed a certain level.

To truly decide if you need to collect Wyoming excise tax, you need to understand what is and is not taxable.

Taxable items in Wyoming predominantly comprise sales of tangible personal property—which is to say, real or personal property that can be felt or touched. Retail sales account for the lion’s share of these transactions, although the scope of taxable sales does extend to certain services and instances of admission. Examples include:

- Sales of cigarettes, tobacco products, and alcoholic beverages

- Leases or contracts involving the transfer of tangible personal property

- Intrastate passenger transportation

- The supply of gas, electricity, or heat for domestic, industrial, or commercial use

- Lodging services

- Admission charges for places of amusement, entertainment, recreation, games, or sporting events

- Services designed to repair, alter, or improve tangible personal property

There are specific circumstances where sales will not be subject to tax in Wyoming. One example is when a purchaser provides a Streamlined Sales and Use Tax Agreement Certificate of Exemption form or a Direct Pay Permit at the time of purchase. Additionally, some types of sales are considered universally non-taxable across the state. Some examples include:

- Sales to governmental entities

- Sales involving qualifying farm equipment or tools

- Livestock, livestock feed, seeds, roots, and similar sales for the purposes of products being sold

- Sales made to religious, charitable, or non-profit organizations

Do you have sales tax nexus in Wyoming?

Sales tax nexus, a relatively new concept, has emerged in response to the growth of non-traditional sales avenues such as internet sales and e-commerce. Understandably, this evolution can be a bit confusing.

Once upon a time, sales tax collections and remittances were straightforward—they were solely expected from businesses operating from brick-and-mortar stores. Fast-forward to our digital age and things have changed significantly. The responsibility of who needs to collect and remit sales tax has shifted, and it now includes many online sellers as well.

Sales tax nexus falls into two primary categories: physical and economic. Let’s explore both.

Physical sales tax nexus in Wyoming

The idea behind physical sales tax nexus is pretty simple—it’s about having some form of physical presence in Wyoming.

You know you’ve set up a physical nexus when you have or maintain an office, a place where you distribute goods from, some inventory storage, or any type of business location in Wyoming. Additionally, having traveling salespersons or other solicitors in the state constitutes physical nexus.

All of these physical nexus indicators apply to both local and out-of-state businesses and require a sales/use tax license in Wyoming regardless of how many or how often sales are made.

Economic sales tax nexus in Wyoming

Remote sellers or marketplace facilitators who don’t have physical nexus in Wyoming are also liable for sales tax collection if they exceed the economic nexus thresholds set by the state. These thresholds are:

- Gross revenue from all sales into Wyoming exceeding $100,000 in the previous or current calendar year

- 200 or more separate transactions sourced to Wyoming in the previous or current calendar year

If a seller with no physical nexus meets one or both thresholds, they will have economic sales tax nexus in Wyoming and are required to register for a license.

Are marketplace facilitators required to collect and remit sales tax in Wyoming?

Yes, marketplace facilitators are obligated to register, collect, and remit sales tax in Wyoming. Facilitators with a physical presence in Wyoming must register for a sales/use tax license – no matter how big or small their sales or transaction volumes are. Those working virtually with no business operations in Wyoming must cross over either of the economic nexus thresholds to be responsible for sales tax.

So, where does this leave you if you’re a retailer selling through one of these marketplace facilitators? Let’s break it down: Marketplace facilitators are seen as the vendors for all sales made via their platforms even if you, as a marketplace seller, listed them in the first place. Due to this arrangement, it’s up to the facilitator to handle sales tax collection and remittance. So, you have no sales tax responsibility on those transactions.

If you’re a marketplace seller and your only sales are through a facilitator with economic nexus in Wyoming, there’s no tax for you to deal with. But if you have other sales happening in Wyoming—such as on your own website—you’ll need to separate those from sales made through the facilitator to figure out if you have an economic nexus yourself.

What platforms are marketplace facilitators?

What is a marketplace facilitator?

A marketplace facilitator, sometimes referred to as a Multivendor Marketplace Platform (MMP), is an online platform that allows customers to purchase goods or services from various vendors in one convenient location. These platforms can benefit businesses by increasing product visibility and attracting a larger customer base. Additionally, marketplace facilitators often have the legal responsibility to collect and remit sales tax on behalf of sellers, which can help ease the sales tax burden for businesses.

Filing Wyoming Sales Tax

If you’ve determined that you have nexus in Wyoming, your first step to sales tax compliance is applying for a Wyoming Sales & Use Tax License. There are a few ways of applying which we’ve detailed in the table below.

| Registration Method | Who It’s For | Information | Links |

| Online Application | All Businesses | The best option for all businesses who only need to register with Wyoming and those with access to a computer or the internet. | WYIFS – Wyoming Internet Filing System for Business |

| Paper Application | All Businesses | The traditional method. Not encouraged for remote sellers but allowed. | Sales and Use Tax License Application |

| Streamlined Sales Tax Application | Remote Sellers or Marketplace Facilitators | For businesses or retailers with no physical presence in Wyoming who need to register with multiple states at once. | Streamlined Sales Tax Registration System |

Once you finish the appropriate application process tailored to your business, you can usually expect to receive your sales and use tax license within ten business days. With the license in hand, you’re all set to collect sales tax from your customers.

In Wyoming, sales tax collection follows a destination-based system. Here’s what that looks like: If a sale happens at your business location, the tax rate for your specific location is what’s applied. For purchases shipped to another Wyoming jurisdiction, the tax rate of the buyer’s location is applied. When dealing with taxable services, sales tax gets tacked on according to the jurisdiction where the customer first uses the service.

Keep in mind that the state’s standard 4% rate is added to every sale, along with any applicable local sales tax rates. Need to determine local rates? These handy charts can guide you.

When it comes time to file, all licensed vendors are required to file a tax return even if there are no gross sales to report and no tax liability due. There are a few different filing methods:

| Filing Method | Details | Useful Links |

| Online Filing | Vendors with internet access are encouraged to file sales tax returns and remit payment electronically. To use the online filing system, you will need to create a username and password and receive a PIN from Wyoming. | |

| Paper Filing | Paper returns will be mailed or posted on the internet filing system 30 days prior to your return due date. These returns are not available anywhere else. There are two types of paper forms for vendors depending on filing frequency: Form 41-1: For monthly or quarterly filers. Form 42-1: For annual filers. | Form 41 Instructions Form 42 Instructions |

| SalesTaxSolutions.US | We offer an efficient and reliable choice for businesses in need of sales tax filing services. With our customized systems, we not only ensure correct tax collection but also automate sales tax reporting to help you meet all the deadlines. | Contact Us Our Services |

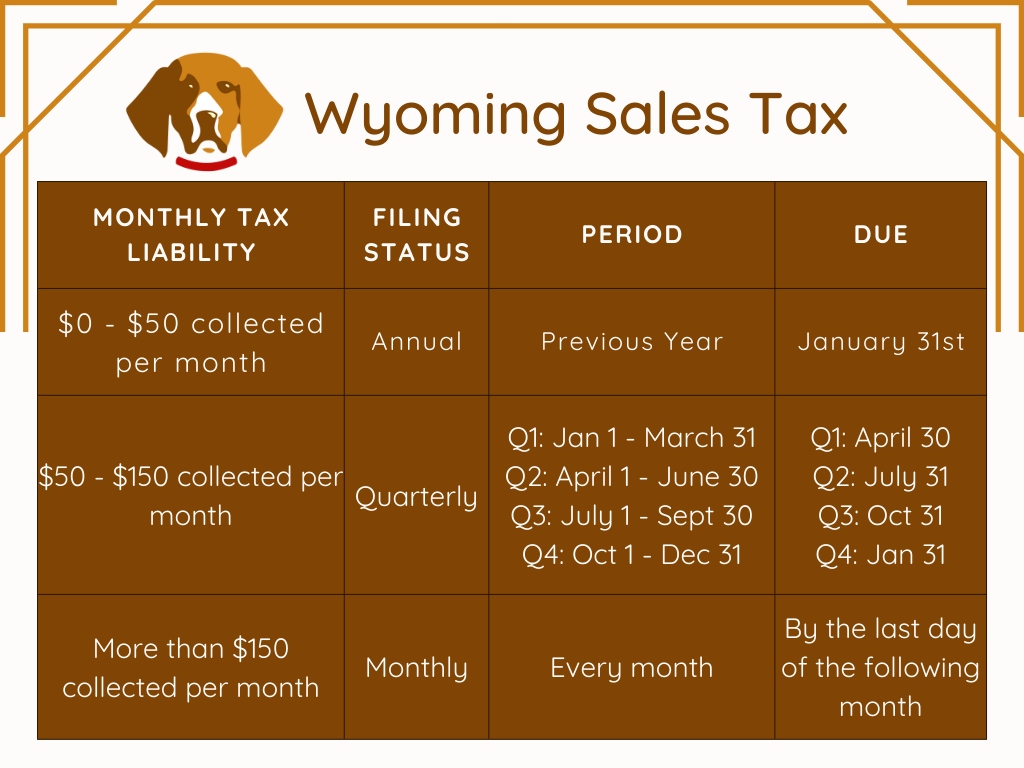

When are sales tax returns due in Wyoming?

Wyoming assigns a filing frequency to each registered vendor based on estimated sales volume. Each filing frequency determines how often a return will need to be filed. Check out the graphic below for a breakdown of filing frequencies and their due dates.