In the last six months, we have made several billing changes aimed at simplifying and improving sales tax management for our clients. From integrating services with our new client portal to upfront billing, we’ve modernized our systems to be more transparent, user-friendly, and organized.

These changes have steadily improved our services, but any change can be a learning curve. In this article, we dive into the exciting billing updates we’ve made and why we decided to implement them. With these new systems and policies in place, client sales tax management is easier than ever.

New Client Portal

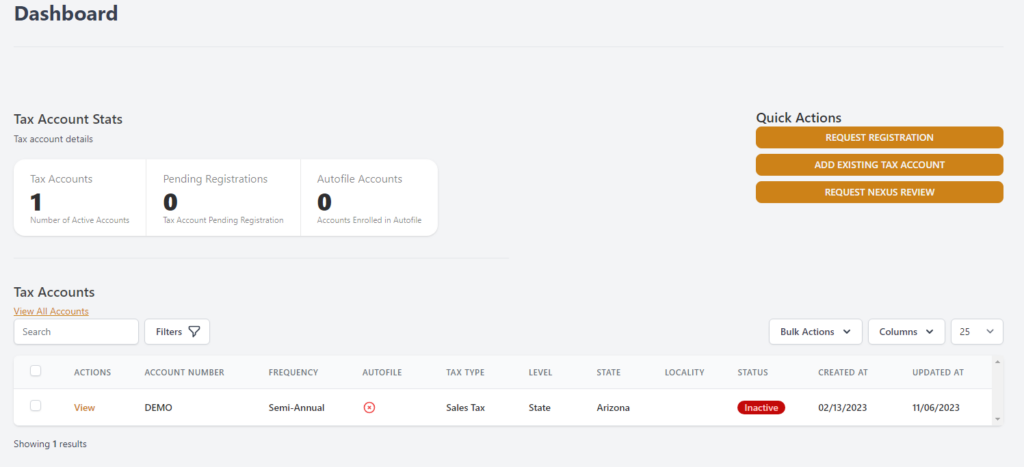

Since the client portal launched in late 2023, we have been hard at work optimizing the application. A substantial portion of these updates have centered around payments and billing. While the client portal is still in its infancy, it has already improved the visibility of invoices and tax accounts, as well as better control over payments and services.

When billing features are fully integrated with the portal, clients can save their payment information with credit card or bank account numbers. This will allow us to securely store payment credentials and process monthly invoices automatically, without any additional action needed on the part of our clients. The portal will handle the entire payment process on the first day of each month, which means no more worrying about logging in and paying invoices yourself!

More features to look forward to in the client portal include:

- Adding and managing services.

- Online services checkout.

- Updating business information.

- Adding multiple businesses and team members to your account.

Upfront Billing – Predictability and Transparency

As of September 2023, we bill all services at the beginning of each month instead of at the end. This ensures clients have full awareness of upcoming costs, allowing for easier financial planning, budgeting, and awareness of sales tax obligations. Upfront invoices itemize all services for the month, like subscription costs, returns due, reimbursments, and any other sales tax services.

Before this change, services were billed after completion each month. However, billing upfront has important benefits for both parties:

- Greater predictability and budget confirmation for clients.

- Reliability in cash flow, which reduces our costs and keeps services affordable.

- All services, costs, discounts, and credits are enumerataed ahead of time.

- We refund any incomplete items on the next invoice with complete transparency.

- Invoices are sent by the 27th of each month and withdrawn on the 1st, so clients have time to ensure that funds are made available in their account.

All in all, upfront billing will help us provide better sales tax services to our clients. It’s a win-win.

Automatic Payments – Security and Convenience

To ensure that clients get what they need and that there is no delay in payments, we require all United States clients to be set up with autopayments. We always provide 3 days advanced notice before withdrawing funds, ensuring there are no surprise charges. Additionally, there are no service fees for credit/debit cards, so clients can choose whether they want payments drafted directly from their bank account or from a card.

Currently, automatic payments have to be setup by filling out a Boswick Autopay Authorization form and emailing it to [email protected]. Once the online services checkout feature is available on the portal, clients will be able to add bank account or credit card information directly to their business profile.

Of course, saving sensitive information like account numbers can be nerve-wracking. We want to assure clients that our industry-leading encryption and security measures will protect any stored financial information. All numbers are tokenized so that the full data is never stored on our servers.

By saving payment methods in the portal, the billing process is streamlined. We all forget to pay a bill sometimes, and remembering to log in and submit manually can mean even more delays and missed deadlines. By enabling autopayments, we ensure timely execution of our sales tax services and eliminate additional work and stressors for our clients.

Billing Changes FAQ

Will I be notified before funds are withdrawn?

Yes. Invoices are generated and notifications are sent out on the 27th of each month.

When do autopayments process?

Autopayments are processed on the 1st of the month. It can take up to 2 days before the funds are withdrawn from your account.

Is there a service fee for credit/debit cards?

No, you can choose to use a bank account or a credit/debit card for autopayments with no extra fees involved.

How can I see my invoices?

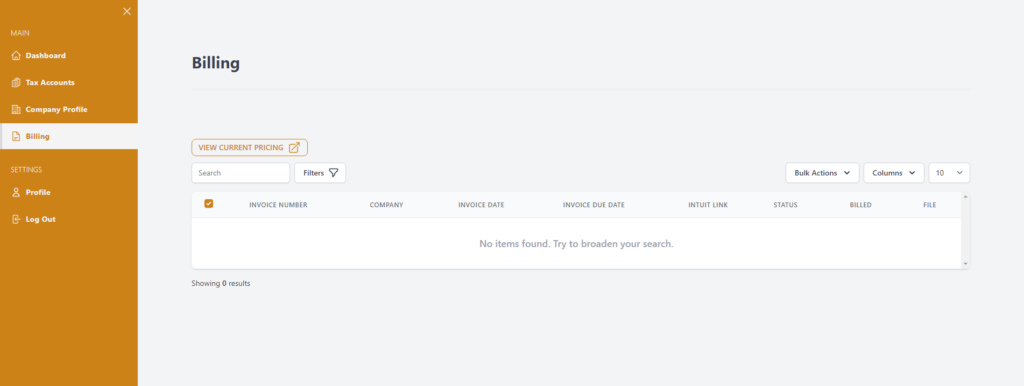

All past and current invoices can be reviewed in your client portal account. You can find these in the Billing tab on the lefthand menu.

What do I do if my bank or card information changes?

Currently, the only way to update your payment information is by filling out another Boswick Autopay Authorization form and emailing it to [email protected]. Once autopayments are integrated into the client portal, you will be able to update your payment information directly on the portal.

What sales tax services come with my subscription?

Subscription services include:

- Tax account maintenance (such as bank account and address changes)

- Notice handling

- Return preparation

- Exporting and organizing sales data

- Payments remitted on your behalf

You can find more details on our sales tax services here!

Do I get charged per return filed?

Yes. Returns filed for clients with a subscription cost $29 each. Returns filed without a subscription are charged at $34 each.

Are registrations billed with monthly invoices?

New registrations are billed at the time of request, separate from monthly invoices. Learn more about how we register our clients in this post.

Modernizing Sales Tax Systems

At SalesTaxSolutions.US, we recognize the need to continuously improve and modernize our systems in order to better served our clients. Upgrading our billing processes and streamlining the client portal are just two ways we can stay on the cutting edge and provide an exceptional client experience. Continuing to modernize our systems requires a significant investment of time and money, but we’ve already seen a marked improvement in our processes and client communication. Here are some more benefits we are looking forward to:

Increased automation and efficiency

By integrating new features like automatic payments, a checkout process, and sales data platform integration into our client portal, we significantly reduce manual work for both our team and clients.

Enhanced reporting capabilities

Speaking of sales data, our client portal remembers past imported transactions we receive from your sales platforms, allowing you and our team to quickly reference past sales information. Now, all of the sales tax you collect from multiple sales platforms can be found in one place.

Flexibility and scalability

As our infrastructure grows and develops, we will have greater ability to roll out more features, services, and unique sales tax managment plans to meet the diverse needs of our growing client base. As our business evolves, our systems can scale accordingly.

Better fraud prevention

Once the checkout process is live, sensitive payment information can be stored within our client portal. However, we understand that saving sensitive information can be nerve-wracking, which is why we have advanced fraud monitoring and protection. Secure payment storage gives our clients added peace of mind.

Ready to take the mystery out of sales tax? Contact us today for a free consultation!