In today’s economy, every dollar counts. And when it’s time to buy the essentials, extra sales tax can stretch already tight budgets even further.

Inflation has risen at unprecedented rates since 2021. In response, some states have moved to eliminate sales tax on goods deemed essential. Oklahoma is the most recent state to have signed a bill saying goodbye to state grocery taxes, following Alabama and Virginia’s lead in 2023. Even more states, like Utah and Kentucky, are actively looking toward eliminating sales tax on certain necessities.

While more states are becoming aware of the potential discriminatory and regressive effects of taxing necessary items, changes aren’t uniform. Some states maintain a firm stance on taxing groceries and other essentials. Even in states eliminating these taxes, many cities and counties opt to keep them. This patchwork approach means that relief from sales tax on certain items really depends on where you live, what action your state legislation chooses to take, and the future impact these decisions will have on state revenue and residents.

Background on Sales Tax

State governments levy sales tax, also known as excise tax or consumption tax, on the sale of goods and services. The tax is assessed as a percentage of the purchase price and is collected by the retailer at the point of sale. As sales tax is not federally regulated in the United States, rates and laws vary by state and local jurisdiction.

West Virginia was the first state to start using sales tax in 1921, and other states soon followed their lead. Sales tax began to replace general property taxes across the country. This adjustment was a much more successful way for state and local governments to raise revenue. Over one hundred years later, 45 states plus Washington D.C. impose a statewide sales tax.

Local sales taxes are also common across the country. Counties, cities, school districts, and other government authorities often levy additional sales taxes on top of the state sales tax. Alaska, Puerto Rico, and Guam don’t have a state sales tax rate, but allow localities to charge their own rates.

When state and local rates combine, it can mean a hefty percentage for purchasers. Tennessee and Louisiana currently lead the highest average combined state and local sales taxes, at 9.55% and 9.52% respectively. With rates like those, it’s easy to see how sales tax has become a key source of sevenue for state and local governments, generating over $500 billion per year nationwide.

Necessary Items Defined

In most states, sales tax casts a wide net. It encompasses most retail sales and some services, with specific exemptions that require state-approved documentation. However, many states consider certain items to be necessary, and that taxing them is regressive.

Necessary items generally refer to products that provide for basic human health, hygiene, and development. For example, most states consider prescription medications and medical devices to be tax-exempt. A steadily-increasing number of legislation include groceries, feminine hygiene products, baby products like diapers and wipes, and other healthcare products in this category. While definitions vary, there is an increasing push to eliminate sales tax on these needed products.

Oklahoma Bill 1955

On Monday, February 26th, 2024, the Oklahoma State Senate passed House Bill 1955, which eliminates the state grocery tax. This bill was hot on the heels of many recent tax deductions, such as Kansas’ reduction of food tax. While actual tax savings depend on many factors—such as family size—the Oklahoma Senate expects residents to save an average of $700 on groceries per year.

However, there are caveats to consider. House Bill 1955 specifies that food and food ingredients are the only sales upon which the tax cut applies. This includes bottled water, candy, and soft drinks. Taxable items still include:

- Alcoholic beverages

- Dietary supplements (such as vitamins, herbs or other botanicals).

- Marijuana (whether usable or infused).

- Prepared food (like fast food or restaurant fare).

- Tobacco

In addition, this food tax repeal only applies to the Oklahoma state tax rate of 4.5%. Local areas can still charge sales tax on groceries, just without the state tax on top.

More Tax Exemptions by State

Tax breaks on groceries, hygiene products, and diapers aims to provide financial relief to families and individuals. Here’s a look at more states that have removed state sales taxes from necessities.

| State | Exemptions |

| Arizona | Arizona exempts sales of food for home consumption, such as ingredients, candy, and non-prepared foods. Some localities may charge food tax. |

| California | California exempts food products, as well as children’s diapers and menstrual hygiene products from state and local sales tax. |

| Colorado | Most food is exempt from Colorado state tax, but soft drinks, candy, gum, and other prepared cold foods are still taxed. Child and adult diapers as well as period products are also exempt. Municipalities are still allowed to charge sales tax. |

| Connecticut | Food, diapers, menstrual and many other health products are exempt from sales tax in Connecticut. |

| District of Columbia | Food sold for home preparation or consumption is tax exempt in Washington D.C. Diapers and period products are also exempt. |

| Florida | Most medicines, medical items, period products, diapers, and grocery items are tax exempt in Florida. |

| Georgia | Food for home consumption is exempted from Georgia’s state 4% sales tax rate. However, local areas can still charge sales tax. |

| Illinois | Illinois taxes groceries at a reduced rate of 1%, not including potential local rates. However, proposals to eliminate the 1% tax entirely are being pushed. Menstrual products are fully exempt from sales tax. |

| Indiana | Food and food ingredients that are unprepared are not taxed in Indiana. |

| Iowa | Uprepared food products are exempt from state sales tax in Iowa, but local tax may still apply. Prepared food for immediate consumption, like candy and certain beverages, are still taxed. Diapers and period products are exempt. |

| Kansas | Kansas has been steadily reducing its state grocery tax over time. Starting January 1, 2023, grocery tax dropped to 4%. On January 1, 2024, it dropped again to 2%. Come January 1, 2025, groceries will be taxed at 0% at the state level. Local taxes can still be charged. |

| Kentucky | Food and food ingredients are not taxed in Kentucky at the state or local level. Additionally, Kentucky is actively pushing toward removing diaper and tampon tax. |

| Louisiana | Louisiana doesn’t levy state sale tax on unprepared foods for home consumption. Diapers and menstrual products are also exempt. However, certain Louisiana parishes and counties may still tax these items. |

| Maine | Maine considers grocery staples to be exempt from sales tax. Menstrual products are included in the list of staples. |

| Maryland | Only food that is sold by substantial grocery or market businesses for consumption off premises is exempt from sales tax. There are also many other health and medical exemptions, including baby and menstrual products. |

| Massachusetts | Massachusetts exempts food products from sales tax, unless they are previously prepared or provided by a restaurant. Diapers, Tampons, and other health products are also exempt. |

| Michigan | Most unprepared foods are tax exempt in Michigan. Tampon tax was also repealed in 2022. |

| Minnesota | Minnesota excludes most food, clothing, and other necessities like diapers and menstrual products from state sales tax. Local taxes may still apply. |

| Nebraska | Nebraska exempts many forms of food from tax at the state and local level. Legislature also exempts feminine hygiene products. |

| Nevada | Non-prepared foods are exempt from state sales tax in Nevada. Feminine hygiene products are fully exempt across the state. |

| New Jersey | New Jersey has a full guide with a list of exempt and non-exempt products here, which cover most food items, baby and menstrual products. |

| New Mexico | In New Mexico, food for home consumption is tax exempt if it is sold at a retail food store. Feminine hygiene products are also exempt. |

| New York | Most food and food products sold by food stores in New York are exempt from state and local sales tax. Feminine hygiene products and diapers are also nontaxable statewide. |

| North Carolina | Qualifying food products are exempt from state tax, but a 2% local tax still applies. Non-qualifying food products are taxed at the full state and local rates. |

| North Dakota | Generally, food and food ingredients are exempt from sales tax in North Dakota. Children’s diapers are also nontaxable. |

| Ohio | Most everday purchases, like food not consumed on premises, diapers and related children’s necessities, as well as feminine hygiene products are exempt from sales tax statewide. |

| Pennsylvania | Unprepared foods are not taxable in Pennslyvania. Disposable diapers and other incontinence products, as well as feminine hygiene products are also exempt. |

| Rhode Island | Feminine hygiene products, diapers and other essential clothing products, and food and food ingredients (not including items like candy or soft drinks) are tax exempt in Rhode Island. |

| Texas | Texas exempts most food and grocery items, not including ready-to-eat items. Diapers and menstrual products were also recently deemed nontaxable with the passing of Bill SB 379. |

| Vermont | Diapers, food and beverages (with the exception of soft drinks), and menstrual supplies are all exempt from tax in Vermont. You can find a full list of taxable and nontaxable items here. |

| Virginia | State tax on food and essential personal hygiene products was abolished in Virginia in 2023, but the local rate of 1% still applies. |

| Washington | Most groceries and nonprepared foods are exempt from sales tax in Washington. Menstrual products are also exempt. |

| West Virginia | Nonprepared foods and food ingredients are exempt from West Virginia sales tax. |

| Wisconsin | With the exception of candy, dietary supplements, prepared food, soft drinks, and alcoholic beverages, food is not taxable in Wisconsin. |

| Wyoming | Most food and food products are not taxed in Wyoming. |

Are Local Sales Taxes Also Exempt?

Even though a state may eliminate tax on an item, it is important for shoppers and sellers to understand that local jursidicitons—like counties, cities, and districts—may have the autonomy to impose their own sales taxes on that item.

For instance, Arizona exempts most unprepared food from state sales tax. However, cities like Cave Creek, Gilbert and Prescott Valley still add local tax on these items. These local taxes vary by region, and are generally used to fund regional projects and services like schools and law enforcement. So don’t be surprised if you visit a neighboring town and discover that your grocery bill is slightly higher!

The Impact

When bills are signed and passed to eliminate sales tax on items like groceries and hygiene products, it can have significant impact on both the state and its residents.

How These Eliminations Affect State Revenue

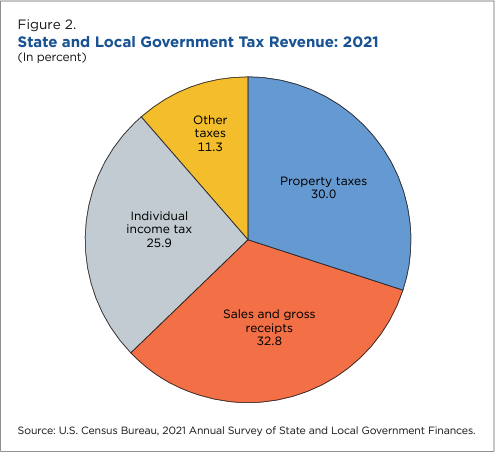

Sales tax has significant impact on state budgets and revenue streams. In the 2021 U.S. Census Bureau Annual State and Local Governments Finances survey, 32.8% of all collected revenue was attributed to sales and gross receipts taxes.

Essential items like groceries, hygiene, clothing and other products make up a bulk of sales tax revenue. Even a three-month grocery tax suspension in Tennesse in 2023 cost the state an estimated $273 million in tax dollars. Along with waiving taxes on menstrual supplies and diapers, the cumulative effect can add up.

While eliminating these taxes reduces some financial burden on citizens, it can leave states searching for ways to make up the difference. They may need to consider raising tax rates in other areas, imposing new taxes altogether, or cutting government spending and services. For these reasons and more, states have to weigh carefully the consequences of removing taxes on essentials.

How These Eliminations Affect Residents

One of the main motivations for eliminating sales tax on necessities is due to the argument that these taxes worsen income and racial inequities. Groceries in particular cosnume a larger portion of income for those living in or near poverty. As quoted from the Center on Budget and Policy Priorities:

“Low-income people … pay much more of their income in sales taxes than higher-income people do because they must spend a very large share of their income to meet basic needs. … The lowest-income fifth of families spends almost twice the share of their annual income on food at home than the highest-income fifth does: 10.3 percent versus 5.7%.”

Center on Budget and Policy Priorities

Advocacy groups have continued to pressure state governments to enact these tax exemptions as a way to provide financial relief to economically disadvantaged residents. Beyond assisting lower income populations, eliminating sales tax on necessary goods serves to make these items more affordable for everyone. Groceries, feminine hygiene products, diapers and other necessities are required purchases for virtually every household at one point or another.

While the savings per item may seem small—especially when looking at states and localities with 2 or 3 percent rates—they add up over time. For most families, the elimination of sales tax on necessities can result in hundreds of dollars in savings per year. And in this economy, that’s nothing to squawk at.